Pendle’s 108% Monthly Gain – Should You Stick Around and Follow This Whale?

![]()

Journalist

- PENDLE holders lock in profits after exponential rise

- The price increase comes on the back of a surge in deposits at Pendle Finance, the platform’s parent company.

PENDLE, the native token of decentralized finance (DeFi) protocol Pendle Finance, has become a hot commodity due to its exponential rise in value over the past few weeks.

Why is PENDLE in the news?

According to CoinMarketCap, the altcoin has gained more than 50% in a week and 108% in a month. PENDLE’s value has more than quintupled since the beginning of the year. At press time, it had a market cap of over $1 billion.

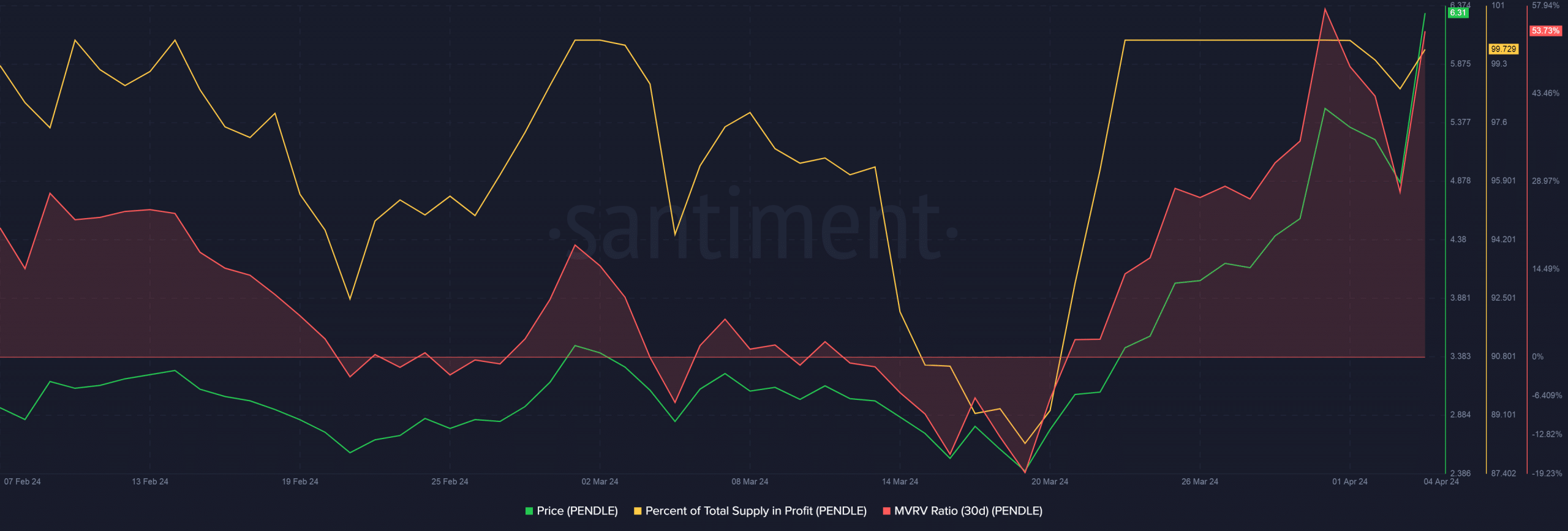

The uptrend led to an increase in coin holders’ profitability. According to AskFX’s analysis of Santiment data, 99.73% of PENDLE’s total supply was profitable at press time.

The 30-day MVRV ratio shows that an average PENDLE investor can expect a 50% return on their investment.

Source: Santiment

Holders also find it difficult to resist these temptations. On-chain tracking platform Spot on Chain reports that a trader was observed moving a large portion of PENDLE to cryptocurrency exchange Binance.

On Thursday, the investor sent 200,000 tokens worth $1.25 million at press time. Four days before this transaction, the investor deposited 162,000 tokens worth $919,000. Both transfers took place when PENDLE was at its highest.

They bought these tokens between 2022 and 2023, when PENDLE was trading at $0.147. The whale still has 200,000 PENDLE in his wallet. This suggests that he expects further price increases.

Pendle Finance sees a rise in TVL

PENDLE is a governance token for Pendle Finance. This unique platform allows users to trade and price tokenized yield assets. The price increase is due to the increase in deposits on Pendle Finance, which were approaching $4 billion at press time.

Source: DeFiLlama

A closer look by AskFX revealed that USDe (a synthetic stablecoin) from Ethena Labs was responsible for the TVL increase. At press time, this asset seemed to offer a 37% annual yield. This encouraged users to deposit their coins on Pendle to increase their income.