Polygons “ATH” – What It Means for the MATIC

Journalist

Posted:

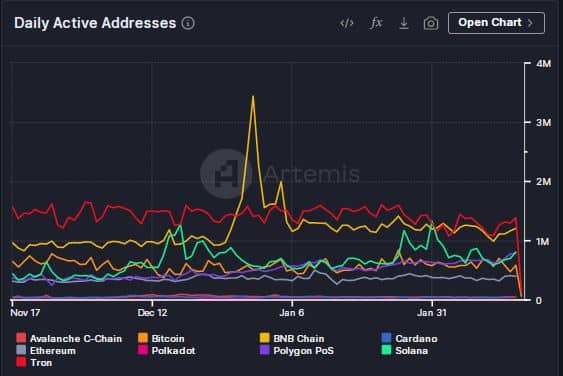

- Year-to-date, the number of daily active addresses has increased by 75%.

- MATIC has surged in recent weeks due to the accumulation of whales.

Polygons [MATIC] As the Proof-of-Stake (PoS chain) continues to grow, there will be a new all-time high in daily active addresses in 2024.

A post on social platform X said that on February 16, the number of unique IP addresses used in network transactions reached 845,530. This represents an increase of 7% compared to the previous day.

Source: Polygon Scan

Last year there was a parabolic increase in the number of people.

Polygon’s network usage began increasing in the latter stages of 2023 and continued into 2024.

Year to date (YTD), the number of daily active addresses increased by 75%. The increase within a year was nothing short of meteoric. A year ago, Polygon only had 285,000 active daily addresses. This is almost a third at the time of writing.

Another important discussion point behind the trend is how Layer-2 was able to outperform base layer Ethereum [ETH] daily users.

Using Artemis statistics, AskFX found that both chains were neck and neck in December. However, the gap widened in 2024 when Polygon gained a large lead over Ethereum.

Source: Artemis

On-chain transactions are declining

It is interesting to note that while the number of users has increased, network usage has not. Since the inscription boom in mid-December, Polygon’s daily average on-chain transaction has fallen by 55%.

Source: Artemis

The futures market is declining on MATIC

According to CoinMarketCap, increasing user engagement is a good sign for MATIC, the chain’s native token, which is has made cumulative gains of more than 10% in the last month.

The number of whales has been at full speed over the last month. This could have contributed to the price increase.

AskFX’s analysis of Santiment data shows that addresses for cohorts with more than 1,000 coins have increased significantly over the last month.

Source: Santiment

Is your portfolio green? MATIC Profit Calculator

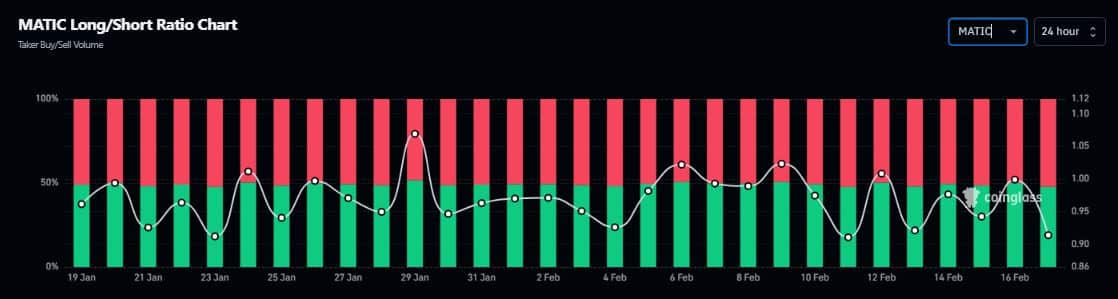

Surprisingly, the majority of derivatives markets were still betting against MATIC’s rise.

Coinglass reports that the longs to shorts ratio was 0.91 at the time of writing. This indicates the dominance of pessimistic leveraged investors.

Source: Coinglass

rnrn