Shib, Be Careful! Wif Flips the Pepe Coin and Becomes the #3 Memecoin

Journalist

- WIF briefly exceeded the $4 price mark.

- The Chaikin money flow indicates the possibility of a reversal.

Dogwifhat based on the Solana meme [WIF] According to Reuters, on March 29, the price of ETH briefly exceeded $4 and reached a new high. Data from CoinMarketCap . The memecoin’s price has fallen 7% since press time to $3.68 per WIF.

WIF is the crypto asset that has made the biggest gains despite the price drop in the last 24 hours. Double-digit price growth during this period has pushed the company’s market cap to $4 billion. This makes it the third largest meme asset after Dogecoin. [DOGE] Shiba Inu [SHIB].

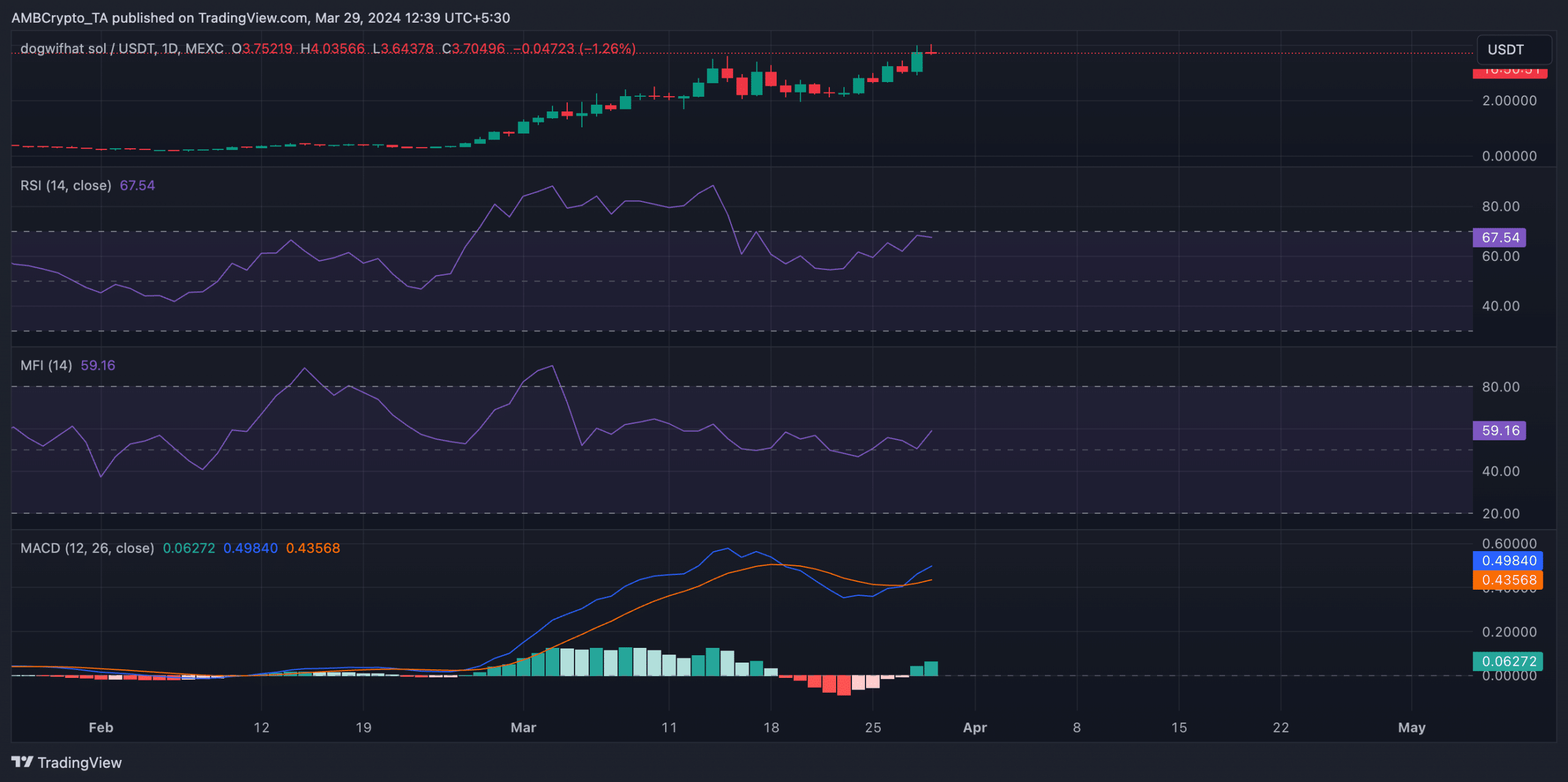

WIF as a 1-day chart

A daily chart of WIF showed an increase in demand for meme coins. At the time of writing, WIF’s key momentum indicators were above their neutral lines.

For example, WIF had a Relative Strength Index of 67.31, while its Money Flow Index was 59.02. These values suggest that WIF spot market participants were more interested in accumulating memecoins than selling them for a profit.

The WIF Moving Average Convergence Divergence (MACD) MACD line crossed the signal lines on March 27, confirming the uptrend.

This intersection is bullish because it shows that the short-term average has moved above the longer-term average. It offers the opportunity to make profits through purchasing.

Source: TradingView, WIF/USDT

Trading volume in the derivatives market for Memecoin increased by 37% to $2.4 billion in the last 24 hours. According to Coinglass, open interest in the derivatives market has also increased by 27% over the same period.

The number of outstanding contracts has increased when open interest in a derivatives market for an asset increases. This indicates an increase in market activity.

The high open interest combined with the positive WIF funding rates showed that investors continued to bet on a sustained rally.

Here is the WIF market cap in BTC.

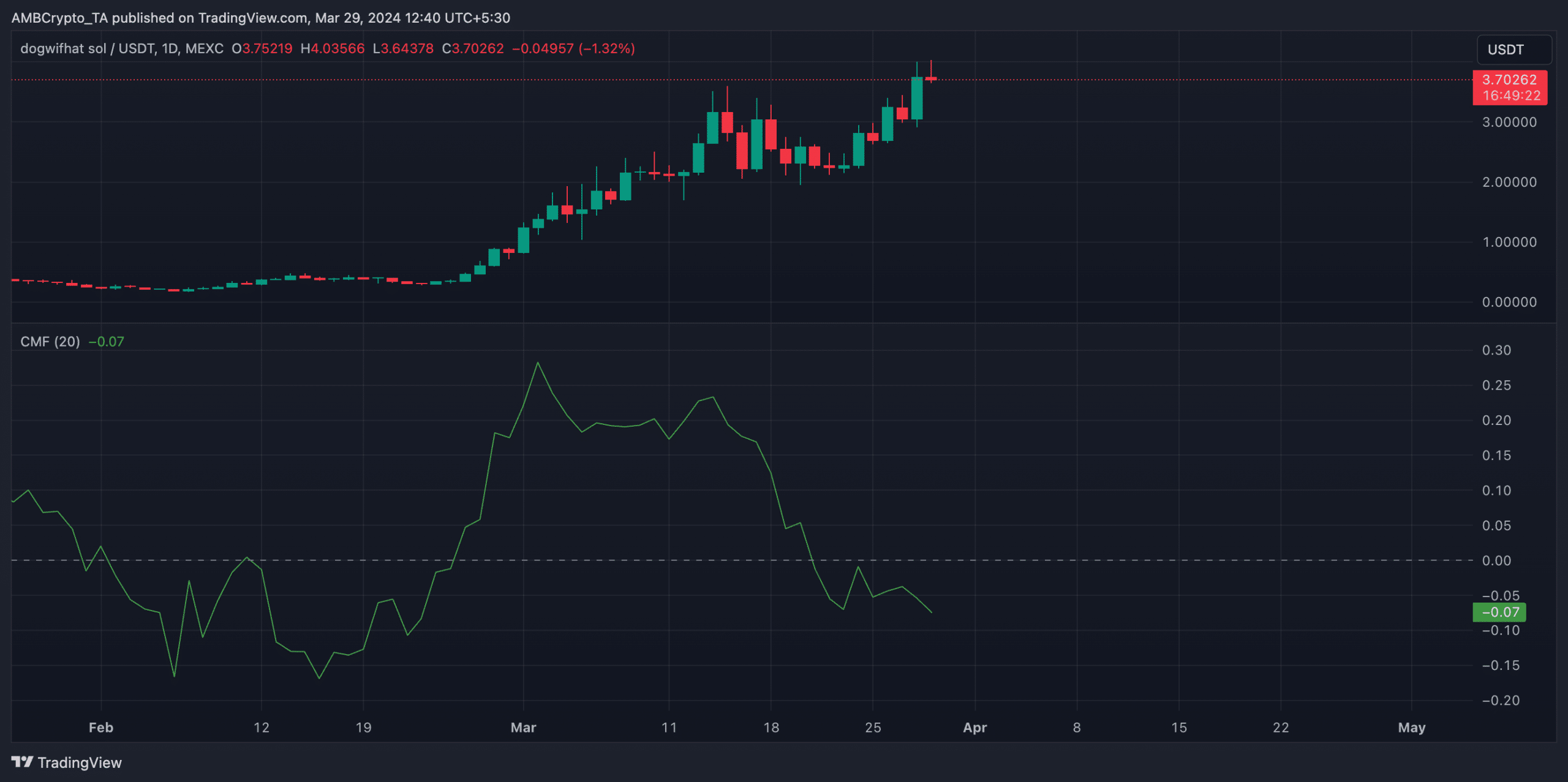

Is there a slight decline in the future?

Since March 16, Chaikin Money Flow (CMF) has been trending downward despite the 360% increase in WIF price over the last month. This has caused divergence, which is often a harbinger of impending price corrections.

This indicator shows how money flows in and out of a crypto asset. This discrepancy between the CMF of an asset and the price movement indicates that the price increase is being driven by a limited pool of buyers. This could also mean that selling pressure is increasing despite a price rally.

Source: TradingView, WIF/USDT