Sol Crashes by 6% in Just 24 Hours: Is Jupiter’s Drop to Blame

Journalist

- Solana remains stable despite increased traffic over Jupiter.

- SOL is down almost 6% in the last 24 hours.

Solana [SOL] Recently there was an airdrop on the network. Numerous users took part in the airdrop, which subjected the network to a stress test.

This event resulted in significant changes in critical network metrics.

Jupiter airdrops over Solana

Jupiter, the largest decentralized exchange on Solana (DEX), conducted an airdrop on the network on January 31st. Airdrops are a popular way to attract users.

Jupiter reached significant milestones before jettisoning. It is now a large network that even surpasses Ethereum. [ETH] in daily quantities.

Data from CoinMarketCap shows that the newly launched JUP token has seen over $1.2 billion in trading volume in the last 24 hours.

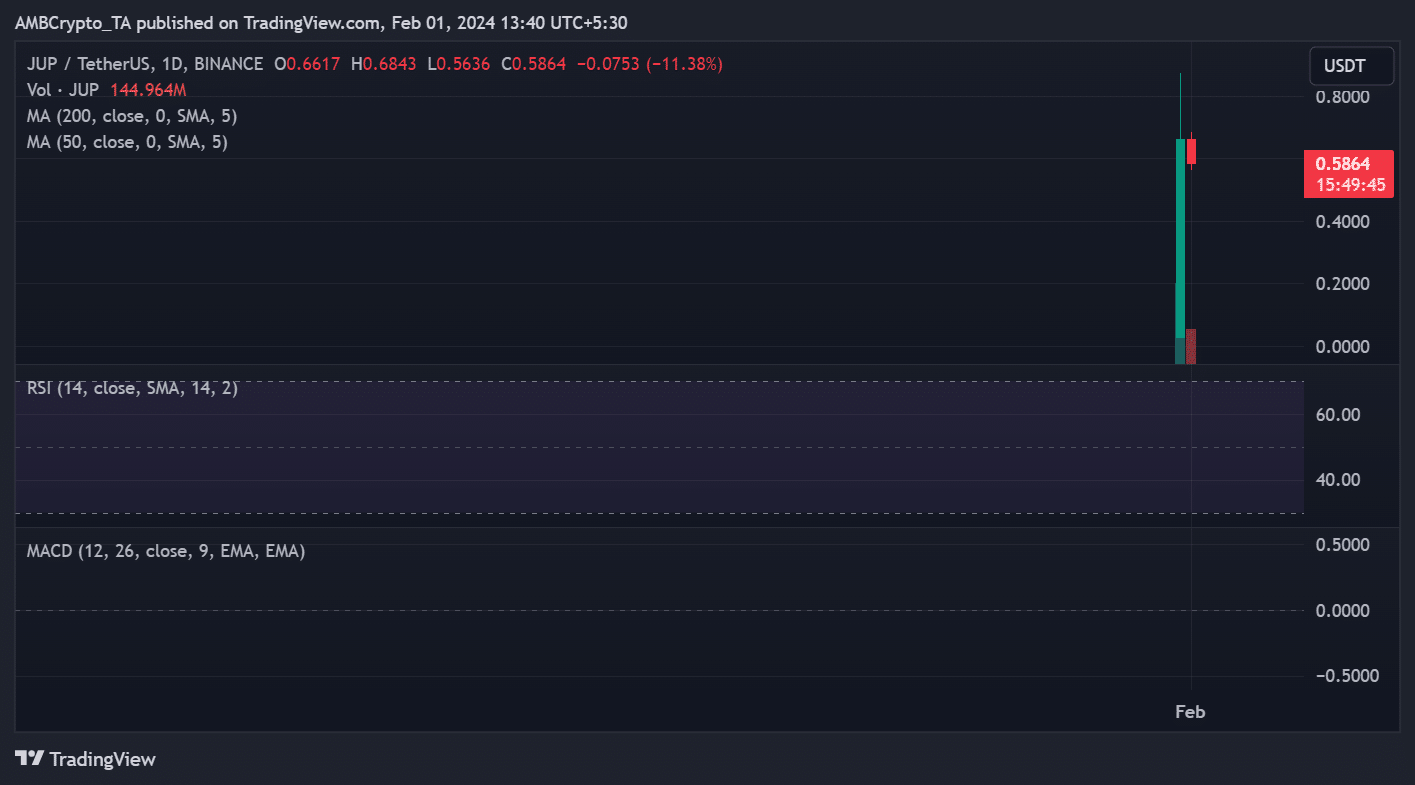

AskFX’s analysis of JUP showed that the token opened at around $0.03. The token rose to $0.8 and then traded at $0.66.

At the time of writing, the trading price was around $0.5, a loss of 11%.

Data from CoinMarketCap showed that the token also lost 60% of its capitalization in the last 24 hours. At the time of writing, the market cap was $790.8 million.

Source: Trading View

Solana remains online despite traffic

Recent concerns about the network’s performance were brought to light by the recent Solana airdrop. This led observers to doubt its ability to handle the increased traffic.

According to a post on X, the network suffered a 45% transaction loss during the airdrop. Nevertheless, the network was able to accommodate traffic.

Solana network uptime was 100%. The network status showed that the network had not been down in the last 90 days.

Solana records record volume

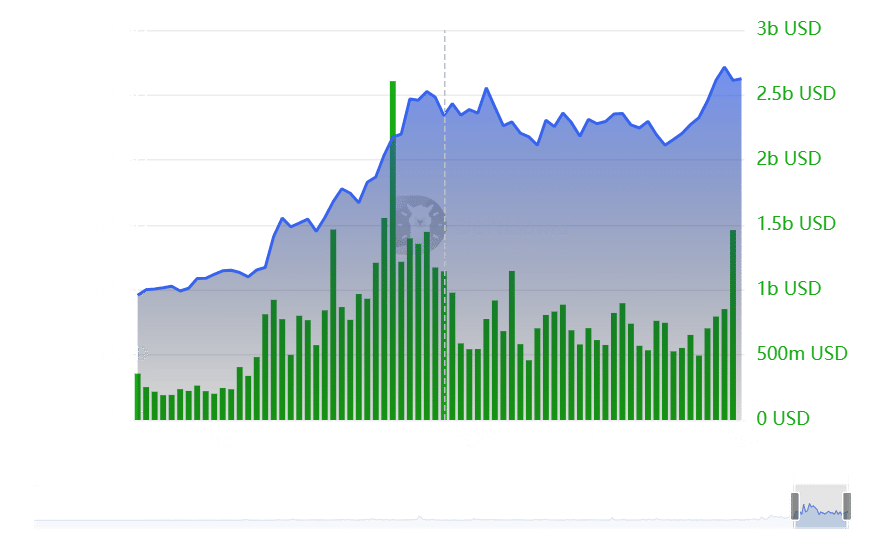

AskFX examined DefiLlama’s data and found that Solana reached its highest volume in history on January 31st. The graph showed a volume increase of around $1.5 billion.

Given the history of the network, it was remarkable. The analysis also revealed that Total Value Locked (TVL) saw a significant increase in the days leading up to the airdrop.

Source: DefiLlama

TVL increased from $1.3 billion around January 23rd to $1.6 billion on January 30th. It currently stands at around $1.6 billion and has declined slightly since its peak.

The data suggests that the Solana network was more active and valuable before the airdrop.

SOL does not fly

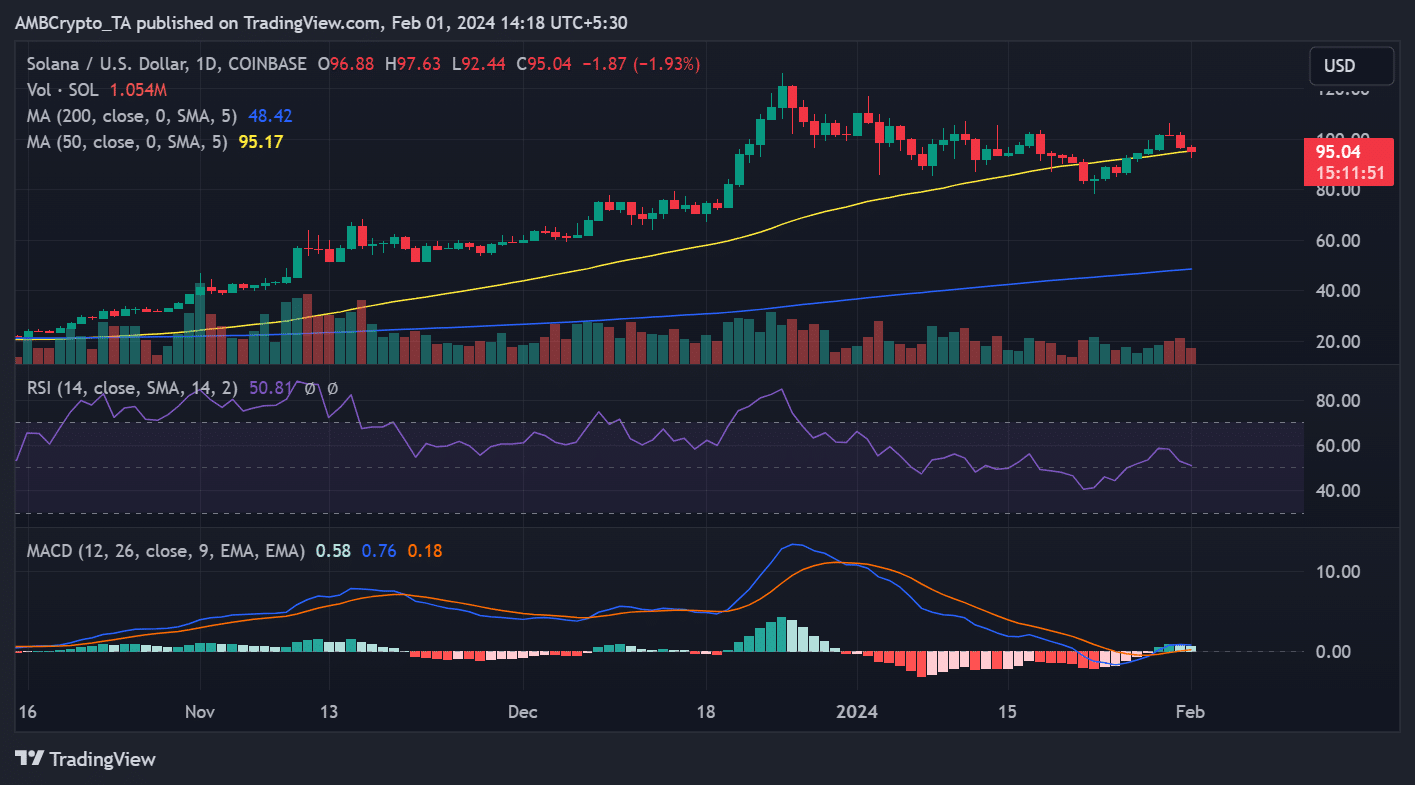

AskFX’s analysis of Solana’s daily timeframe chart found that the event did not have a positive impact on price action.

Is your portfolio green? SOL Profit Calculator

The chart opened on January 31st at around $102. By the end of the trading day, the chart recorded a decline of more than 4%.

At the time of writing, SOL was trading around $95. This corresponds to a further decline of 1.9%.

TradingView