Solana Price Prediction – These Are the Target Prices After Liquidations of Over $9 Million

Journalist

- Solana fell again to the price of $145, triggering a cascade of liquidations in the market.

- With high liquidity, the price could rise by $150.

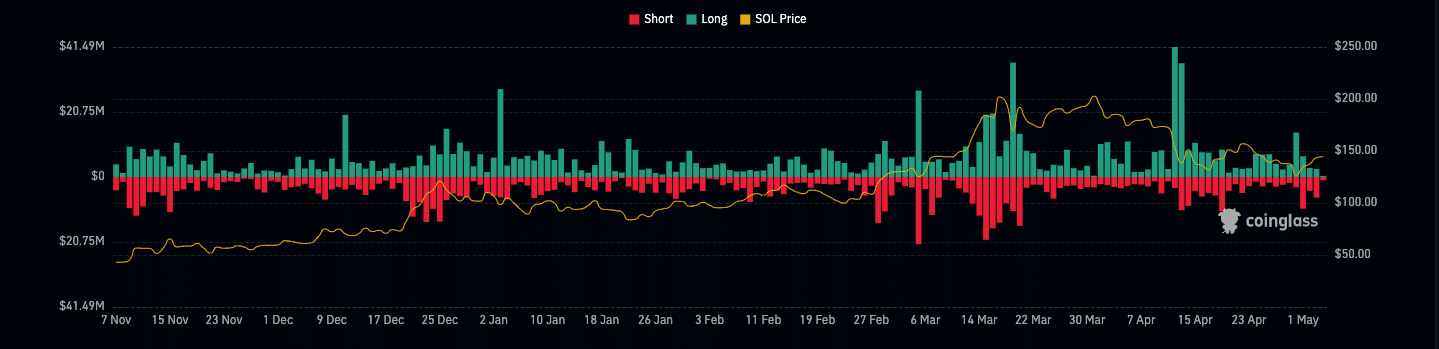

AskFX found that Solana [SOL] In the last 24 hours, $9.14 million worth of positions were liquidated. Long positions accounted for $2.37 million, while short positions suffered the largest loss at $6.77 million.

If a trader does not have sufficient funds to hold a position, he will liquidate it. The original margin may be partially or completely lost. This may be due to high leverage, extreme volatility, or a losing bet.

Longs are traders who bet on an asset’s price rising. The opposite are shorts who predict a decline.

AskFX investigated the matter and found that the price of SOL was responsible for the liquidations. SOL, like other cryptocurrencies in the market, fell on May 2. This made traders believe that the price would continue to fall on the charts.

Source: Coinglass

The forecast does not have to be abandoned

However, the token had other plans. Just two days later, it rose to $145.08. SOL’s value has increased by almost 5% in the last 24 hours. If the price continues to rise, many positions, especially on the short end, could be lost.

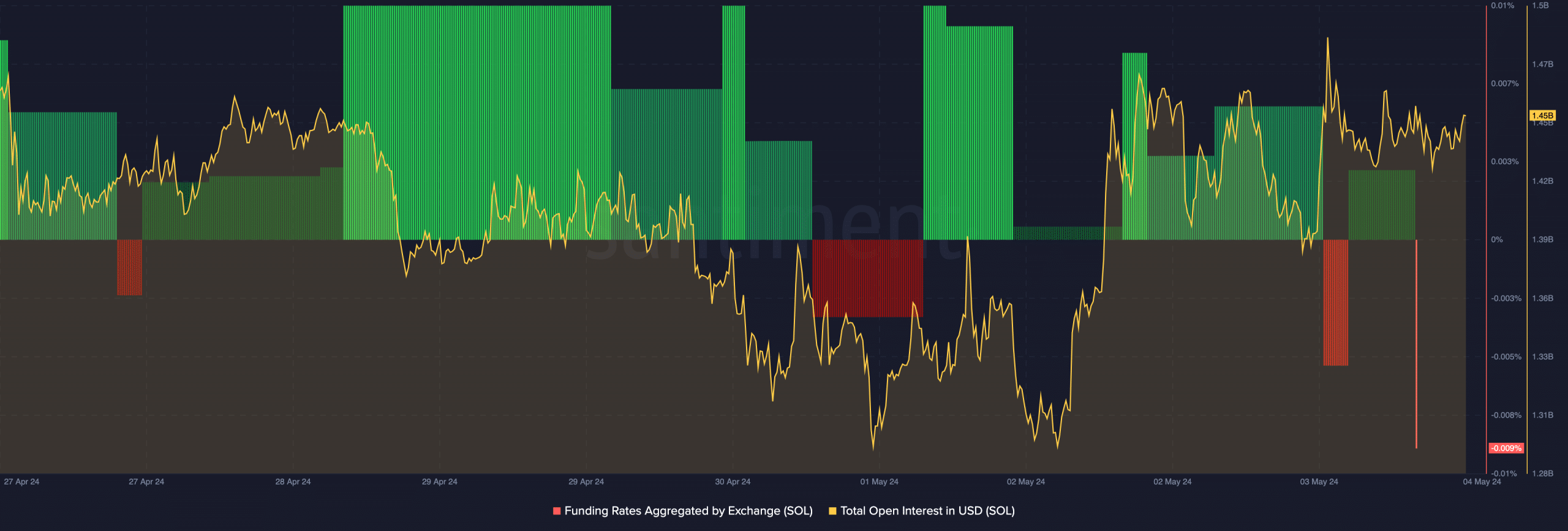

But the liquidations did not stop traders from taking a break. Open Interest (OI) was a good indicator. Santiment data shows that SOL’s Open Interest (OI) rose to $1.45 billion. An increase in OI indicates that more money is entering the market. When OI increases, traders close their positions more frequently.

The increase in OI could be the catalyst for the cryptocurrency’s next direction. SOL’s price could continue to rise north in the short term.

It is important to remember that OI may not be large enough to trigger a rally. SOL could trade within a tight trading range between $145 and $150.

AskFX also noticed something interesting about the funding rate. A positive funding rate means that the perp price of an asset is trading at a higher premium. Longs have to pay a fee to fund shorts.

Source: Santiment

A negative value indicates that the perp is being sold at a discounted price. SOL’s funding rate was -0.009% at the time of writing.

It is possible to get SOL for $160

This high negative value indicates that shorts were aggressive. However, the token’s rising price showed that shorts are not being rewarded. If the metrics continue to hold like this, SOL could strengthen its bullish potential while shorts may be facing another round of liquidations.

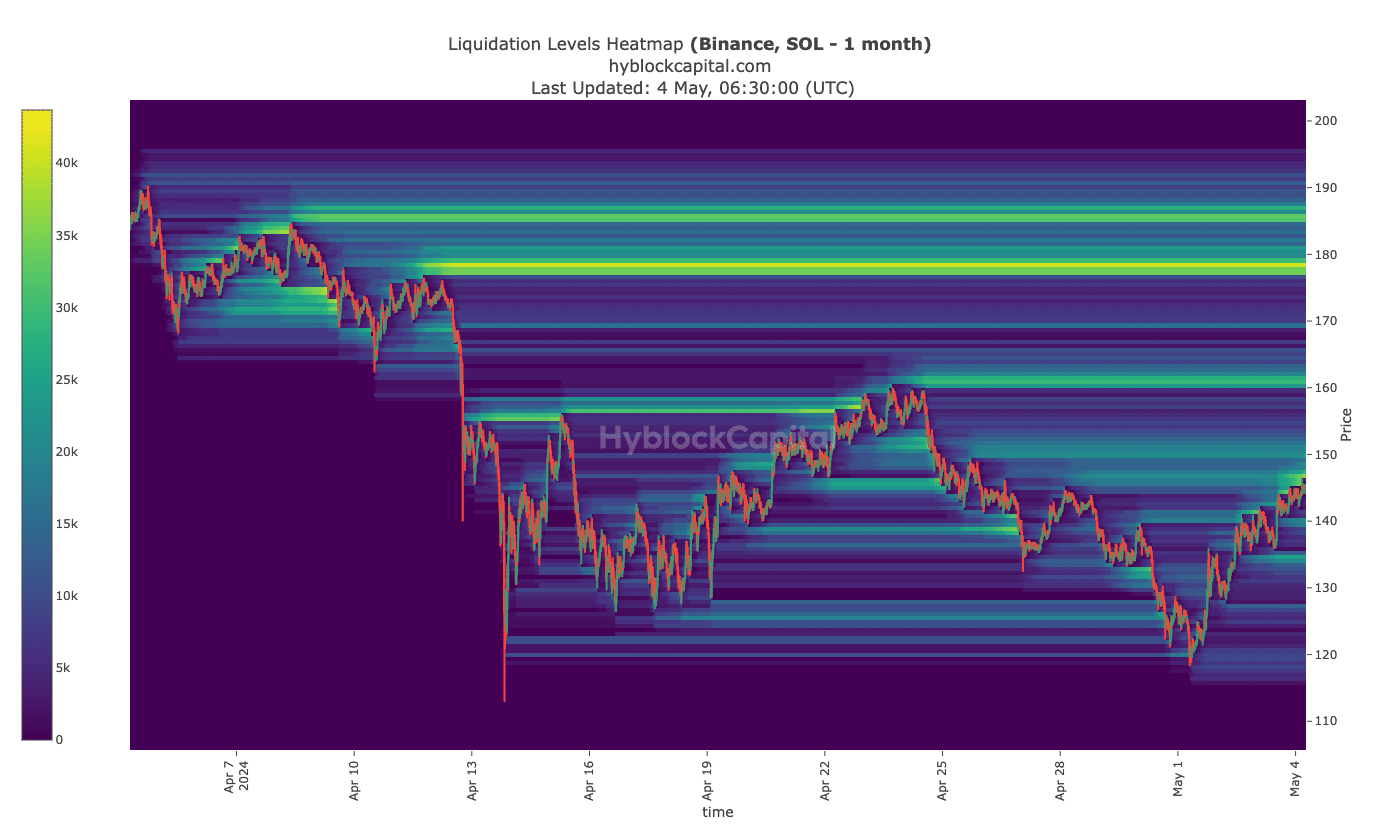

We also looked at the liquidation heatmap, which shows areas of high liquidity. This indicator can also give traders a hint as to which direction the price might move.

According to Hyblock data, there is high liquidity at around $150, $160.80, and $178.47 (all yellow). This suggests that SOL could move towards these zones.

Source: Hyblock

Read Solana’s [SOL] Price Predictions 2024-2025

If the altcoin’s price continues to rise, the first target would be $150. That’s the state of things. It might face some resistance.

A successful breakout could cause a price jump to $160. This could be a good short-term move.