Spot Bitcoin ETF Approval Will Trigger “Selling Pressure” in CME Futures Market: K33

-

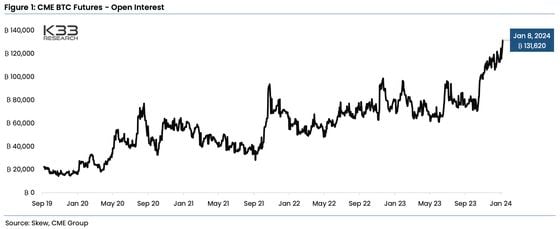

Open interest in CME Bitcoin futures reached $6.2 billion on Tuesday as institutions bet more on the approval of a Bitcoin ETF.

-

K33 Research predicts that the trend will soon reverse as investors may quickly liquidate their positions if ETF approval is granted.

Open Interest (OI) – active trading positions - for BTC futures contracts on the Chicago Mercantile Exchange, the largest BTC futures trading venue The value of Bitcoin, preferred by sophisticated investors, reached $6.2 billion, or 132,900 BTC, during the day. These are both new all-time records, CoinGlass data shows.

The value of the CME Bitcoin OI has almost doubled from 72,000 BTC at the end of October as market participants bet that regulators will allow spot-based Bitcoin exchange-traded funds that can hold Bitcoin directly. Steady inflows The rise of Bitcoin futures ETFs such as ProShares BITO (which holds BTC futures on the CME) and other futures-based ETFs such as ProShares BITO (which holds BTC futures traded on the CME) contributed also contribute to this.

According to TradingView, CME monthly futures contracts were priced at a premium of 18.7% per traded at the spot price for a year.

K33 Research has forecast a positive result for Tuesday Market Report. This regime will not last and open interest and premiums will decline if a spot Bitcoin-based ETF is approved in the US ( *) ) Reportedly, 43% of CME Bitcoin futures contracts were held by futures-based ETFs. Futures funds will have to close positions as investors are likely to move their funds into cheaper ETFs and switch to cash funds. This will lower the open interest and premium.

According to the report, the remaining 57% of contracts are held by active market participants. Their commitment has increased by 128% in the last three months, from 33,000 BTC to 75,000 BTC. The current premium makes it very expensive to hold these positions, according to K33, who predicts investors will want their profits once the Bitcoin ETF is approved.

Anders Helseth, a K33 analyst, and Vetle Lunde, a K33 analyst, wrote: “All things being equal, this structural rotation will lead to selling pressure.” The CME’s record-breaking all-time high regime may be coming to an end.