The Bitcoin Price Rally Is Focused on the Futures Spread, Which Underscores the Need for Spot ETFs

The recent Bitcoin (BTC) rally has reignited concerns about a market quirk that puts futures, futures-based ETFs and other exchange-traded products (ETPs) traders at an unjustified disadvantage compared to coin holders.

At the end of last month, the cryptocurrency reached its highest level in over a year. The spread between the prices of the July futures contract listed on the Chicago-Mercantile Exchange and the June futures contract, which was then the front month, exploded to as high as $500. This is the largest gap since the late 2021 bull market.

Crypto market participants have been paying attention to the sharp widening or “steepening” of the spread. The spread increases the cost of rolling over prior to expiry or moving bullish positions from the front month contract to the next month contract. It is also impacting the performance and futures-based product offerings of ProShares and VanEck. Observers said the excitement about a possible launch of a spot ETF was justified.

Futures contracts have an expiry date, forcing traders to roll over their positions before settlement. Rollovers occur when the spread between the current month’s contract and the following month’s contract widens. Traders sell the expiring contract at a lower price and enter into the new contract at a higher price.

We were not surprised by the increase in contango in the bitcoin futures market over the past week. The CME bitcoin futures market has historically traded in relatively strong contango, particularly during bull markets. That Congo level will definitely have an impact [futures-based ETF] Matthew Hougan is the Chief Investment Officer of Bitwise Asset Management’s crypto index fund, which also owns ETFs.

This generally shows why a spot-based Bitcoin ETF is superior to a futures-based ETF for most investors. People just want to be able to buy bitcoins in a safe and secure way, with no ifs or buts. Hougan said a spot ETF could achieve that goal.

The US futures ETFs invest in CME bitcoin futures.

The US Securities and Exchange Commission last month received applications for spot-based Bitcoin ETFs from major players in traditional finance, including BlackRock (BLK), Invesco(IVZ), Fidelity and others. Bitcoin surged nearly 12% in June.

If approved, a spot ETF works like the SPDR Gold Trust ETF, which owns gold bullion. Investors can hold their cryptocurrency positions for as long as they like without having to pay the high costs associated with futures-based ETFs or grapple with the complexities of storing them in a wallet. The spot-based ETF also tracks Bitcoin’s current spot price better than futures ETFs.

The spot ETF is a better investment than futures products like the ProShares Bitcoin Strategy ETF. This ETF has underperformed Bitcoin this year. Launched in October 2020, the ProShares futures ETF is the largest and most active futures ETF.

Yahoo Finance reports that shares of the ProShares ETF (BITO) traded on the NYSE are up 79% over the past year. Bitcoin is up 88%. This is a notable loss for BITO investors. BITO suffered more losses than Bitcoin in the 2022 bear market.

Kim said that “the momentum is certainly adding to the excitement around spot ETFs.”

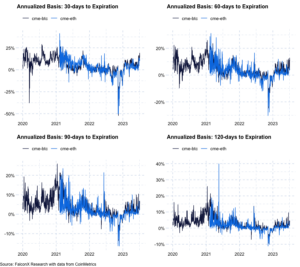

The situation is unlikely to improve if the bitcoin price continues to rise, bringing more buyers into the derivatives markets and the Futures premiums remain high across all maturities.

As of Wednesday, the basis for bitcoin and ether CME futures, or the difference between the futures price and the spot price, was higher at the front end of the curve (30-day and 60-day). .

Kim stated that the 30-day BTC annual base just hit 19%. This is the highest level since October 2021, when BTC traded above $60,000.” Favored by many investors, the 30- and 60-day futures are more popular for Bitcoin than Ether.

Ravi Doshi expressed a similar view, stating, “The bullish sentiment in the market has pushed the CME front-end futures basis higher.”

Doshi says the situation has deteriorated over the past week, when the futures ETFs had to roll over their long exposures from the expiring June contract to the July contract. “Spread illiquidity resulted in a temporary 23% annualized basis in the July contract, costing futures ETF holders dearly.”

3:52 UTC: Year-to-date gain for BITO is 79% In the previous version, this figure was incorrectly stated as 56%.