The Weekly Crypto Market Winners and Losers – BEAM, KAS, XMR, FXS

- Dymension, Beam and Kaspa had the biggest wins of the week.

- Monero, Frax Share and Jupiter were the biggest losers of the week.

This week, some top coins experienced a rally, reaching new highs and influencing the crypto market.

In addition to these leading coins, several others also saw notable gains, with some showing more significant gains.

However, among the winners, some coins suffered losses. Here is AskFX’s list of the biggest winners and losers from February 4th to 10th.

Biggest Winners

Dymension

Dymension (DYM) emerged as the best-performing cryptocurrency of the week, according to CoinMarketCap. DYM got off to a slow start on February 4th, trading with a loss of around $4.2.

However, as the week progressed, the price experienced a significant increase and reached over $7.5 at the end of February 10th.

This remarkable increase amounted to over 90% in the last seven days, cementing its position as the biggest winner of the week.

At the time of writing, DYM was trading at around $7.6, with a market cap of around $1.1 billion.

Beam

Based on data from CoinMarketCap, Beam [BEAM] secured the position as the second highest gainer of the week with an impressive increase of over 57%.

Analysis of the data revealed that BEAM started the week at around $0.017 and showed a steady upward movement throughout the week.

By the end of the week, its value had increased to around $0.024. At the time of writing, BEAM was trading at around $0.026, accompanied by a market cap of over $1.3 billion.

Kaspa

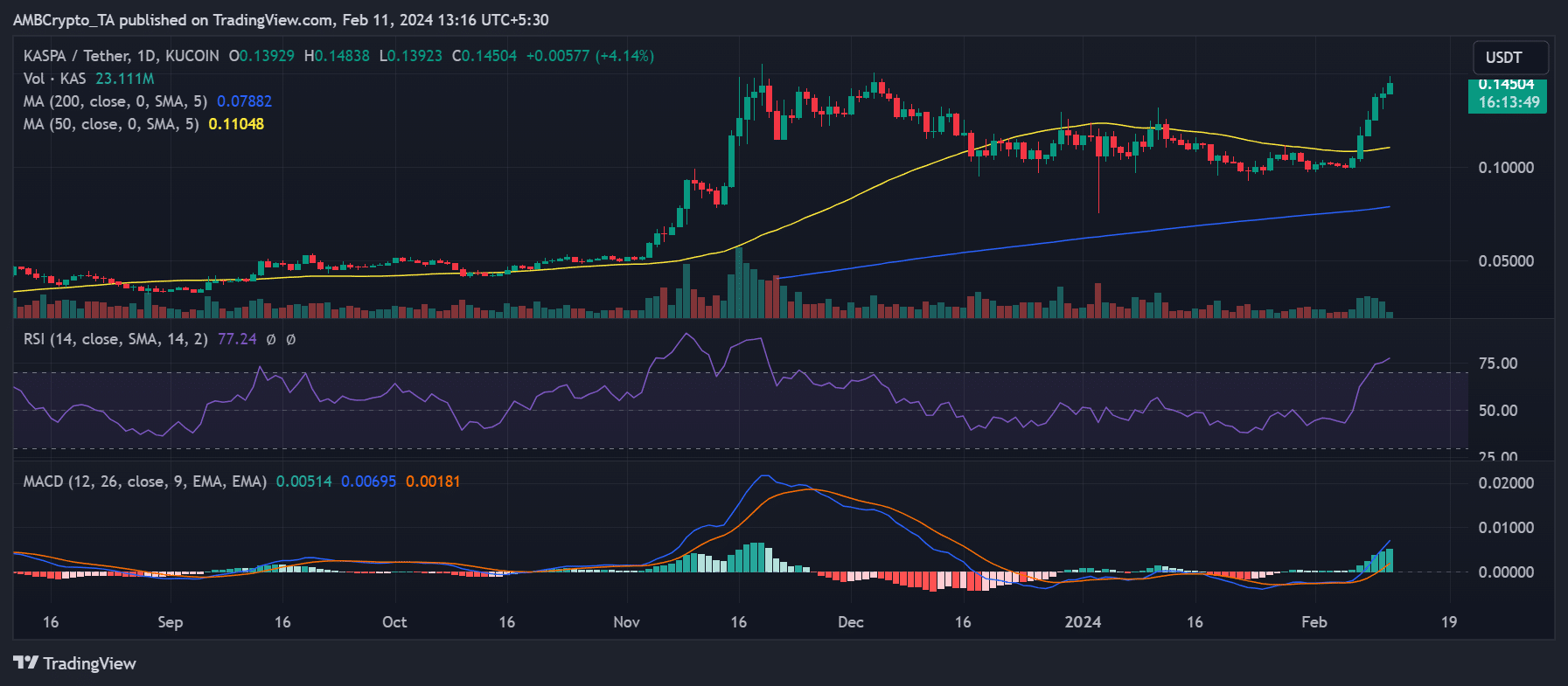

Kaspa [KAS] secured the third-highest gains of the week, according to data from CoinMarketCap.

AskFX’s analysis of the data showed that KAS started the week at around $0.01 on February 4th and saw a slight decline the following day.

However, it saw a rapid increase throughout the week and ended the week at around $0.14, an increase of almost 45%.

AskFX’s look at the daily time chart showed a five-day consecutive uptrend over the past week, which was ongoing at the time of writing. KAS was trading at around $0.14, up over 4%.

Source: Trading View

Also, the market cap at the time of writing was about $3.3 billion.

Biggest Losers

Monero

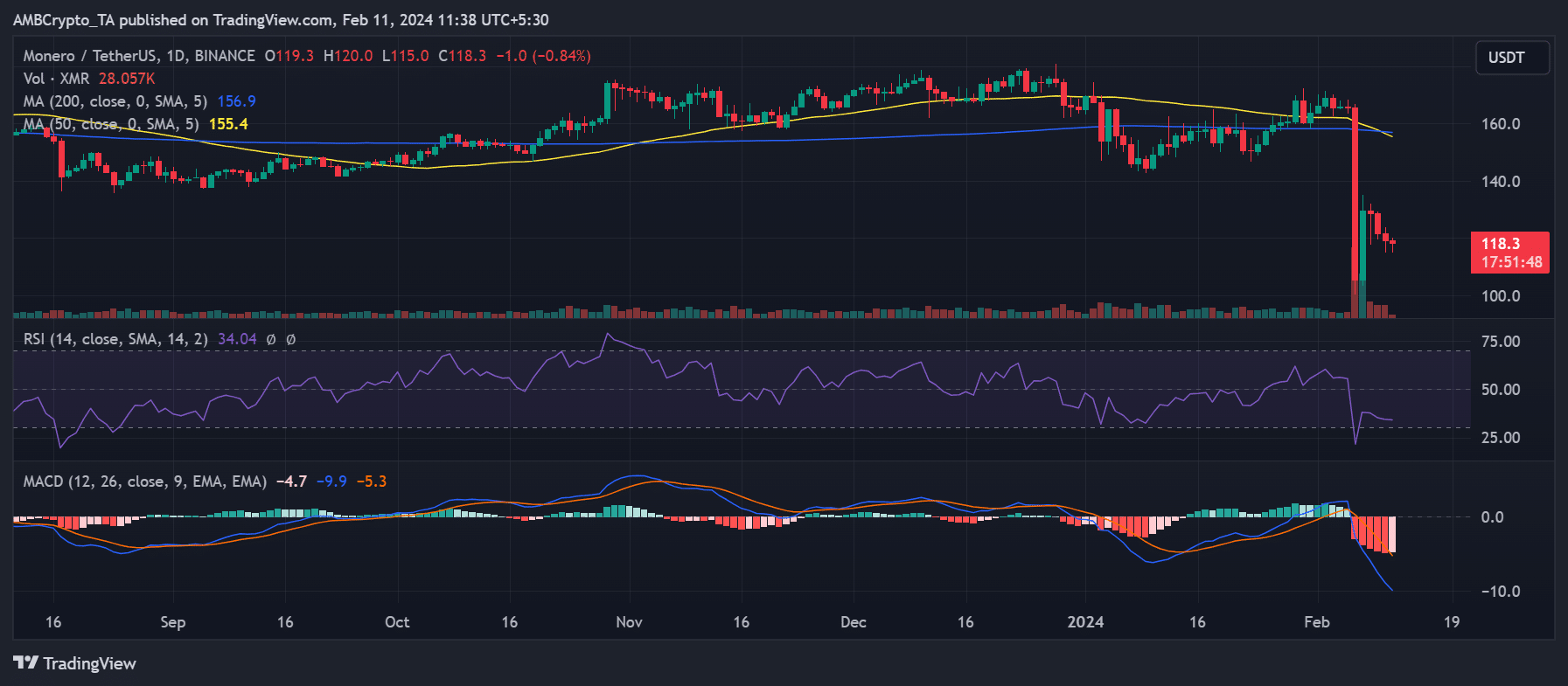

Monero [XMR] started the week on a positive note, trading at around $165. However, the week saw a downturn, resulting in a loss of over 28%, CoinMarketCap reported.

AskFX’s examination of XMR movement on a daily timeframe chart revealed a significant decline of over 36% on February 6th, bringing the price down from over $165 to around $105.

Source: Trading View

Despite attempting a partial recovery the following day, with a nearly 23% increase above $129, subsequent declines followed. At the time of writing, XMR was trading at around $118.

The pronounced downturn that Monero experienced in the last few days can be attributed to an announcement from an exchange.

The exchange announced plans to delist the asset, resulting in a sharp price drop to historic lows. Monero’s market capitalization was around $2.1 billion at the time of writing.

Frax Share

Frax Share [FXS] had its fair share of losses this week, according to data from CoinMarketCap. AskFX’s analysis showed a decline of over 10.6% in the last seven days.

At the beginning of the week the price was in the $10 price range, the next day saw a rise before a decline on the third day.

By the end of the week, its value had fallen to around $9, a range in which it remained at the time of writing. Frax Share’s market cap was around $697 million at the time of writing.

Jupiter

Jupiter [JUP] marked the loser’s corner for the second week in a row, securing the position as the third-biggest loser of the week, according to data from CoinMarketCap.

AskFX’s analysis of the data showed that JUP started the week at around $0.53 and ended the week with a decline to around $0.50.

At the time of writing, the price was trading at around $0.51, representing a modest attempt at recovery. Jupiter’s market cap was around $695 million at the time of writing.

Conclusion

Here is the weekly summary of the biggest winners and losers. It is important to take into account the volatility of the market, where prices can change quickly.

Therefore, it is best to do your own research (DYOR) before making any investment decisions.