UK Stablecoin Regulation Is Taking Shape in Several FCA and BOE Documents

It is not expected to come into force until 2025, but new publications from the FCA and BOE shed light on regulators’ thinking.

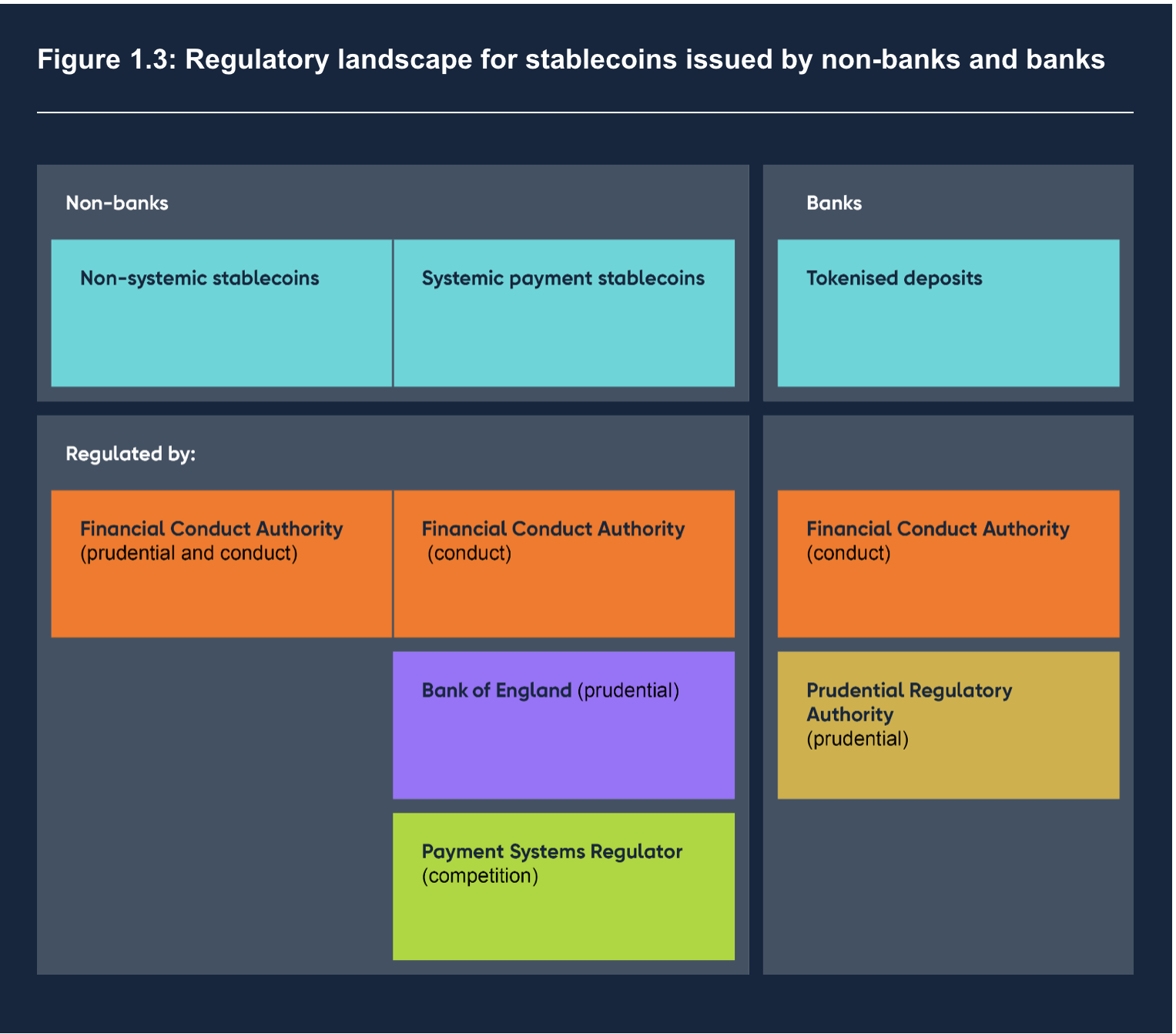

On November 6th, a series of documents dealing with stablecoin regulation were published in the United Kingdom. The Financial Conduct Authority (FCA) has published a discussion paper, as has the Bank of England (BOE). Accompanying this, the BOE’s Prudential Regulatory Authority (PRA) released a letter to depository institution CEOs, and the BOE released an “interagency roadmap” to connect them.

His Majesty’s Treasury set the stage for the flurry of publications on October 30 with a brief document previewing regulatory plans. The FCA paper covered the same issue in much more detail.

Stablecoin regulation is the first step towards more comprehensive regulation of crypto assets, the FCA said. The discussion paper outlined possible use cases for stablecoins in retail and wholesale. The discussion covered auditing and reporting, hedging of coins held by the issuer and the independence of the custodian of the hedging assets.

The paper focused on ways in which the principle of “same risk, same regulatory outcome” could be applied. It was proposed to use the existing system of customer assets as the basis for redemption and custody rules, and management’s arrangements, systems and controls as the basis for organizing business affairs. There are existing operational resilience and financial crime frameworks, as well as numerous others.

The UK FCA proposes that stablecoin holders have the right to direct redemption. This makes issuers much more like banks and will raise a number of AML/KYC issues for issuers pic.twitter.com/lZLQXlmemu

— Sean Tuffy (@SMTuffy) November 6, 2023

The FCA is considering adjusting existing ones Remove regulatory requirements for regulated stablecoin issuers and custodians from the existing system and eventually apply them to other crypto assets.

The BOE paper looked at the use of sterling-based, retail-focused stablecoins in systemic payment systems. This took into account transfer functions and requirements for wallet providers and other services, and partially overlapped with the FCA’s discussion of stablecoin issuers and deposit insurance.

The BOE will “rely on” the FCA to regulate custodian banks, it said, but left open the possibility of imposing its own requirements if necessary. It noted that anti-money laundering and “know your customer” requirements for unhosted wallets and off-chain transactions were potential regulatory weak points.

The BOE’s PRA letter emphasized that the distinction between “e-money or regulated stablecoins” and other types of deposits must be clearly maintained:

“With the emergence of multiple forms of digital money and For cash-like instruments, there is a risk of customer confusion, particularly retail customers, if depository institutions were to offer e-money or regulated stablecoins under the same brand as their deposits.”

Deposit-taking institutions should limit their innovations to deposits. Issuance activities should have clear branding, the PRA advised. An issuer that also wants to take deposits should act quickly and involve the PRA in the process. Ultimately, innovations in the deposit business are also subject to rules and requirements, it was said.

The BOE roadmap included a schedule with an implementation date of 2025.