What Does That Mean for You?

Bitcoin Whales Reach Record Holdings of $529 Billion

Journalist

- Whale wallets have amassed over 7 million BTC

- The cryptocurrency is still above $66,000 despite some declines.

Bitcoin whale wallets have been consistently accumulating BTC over the years and recently reached a record holding. The BTC price has also regained previously lost levels, indicating a possible market recovery or stabilization.

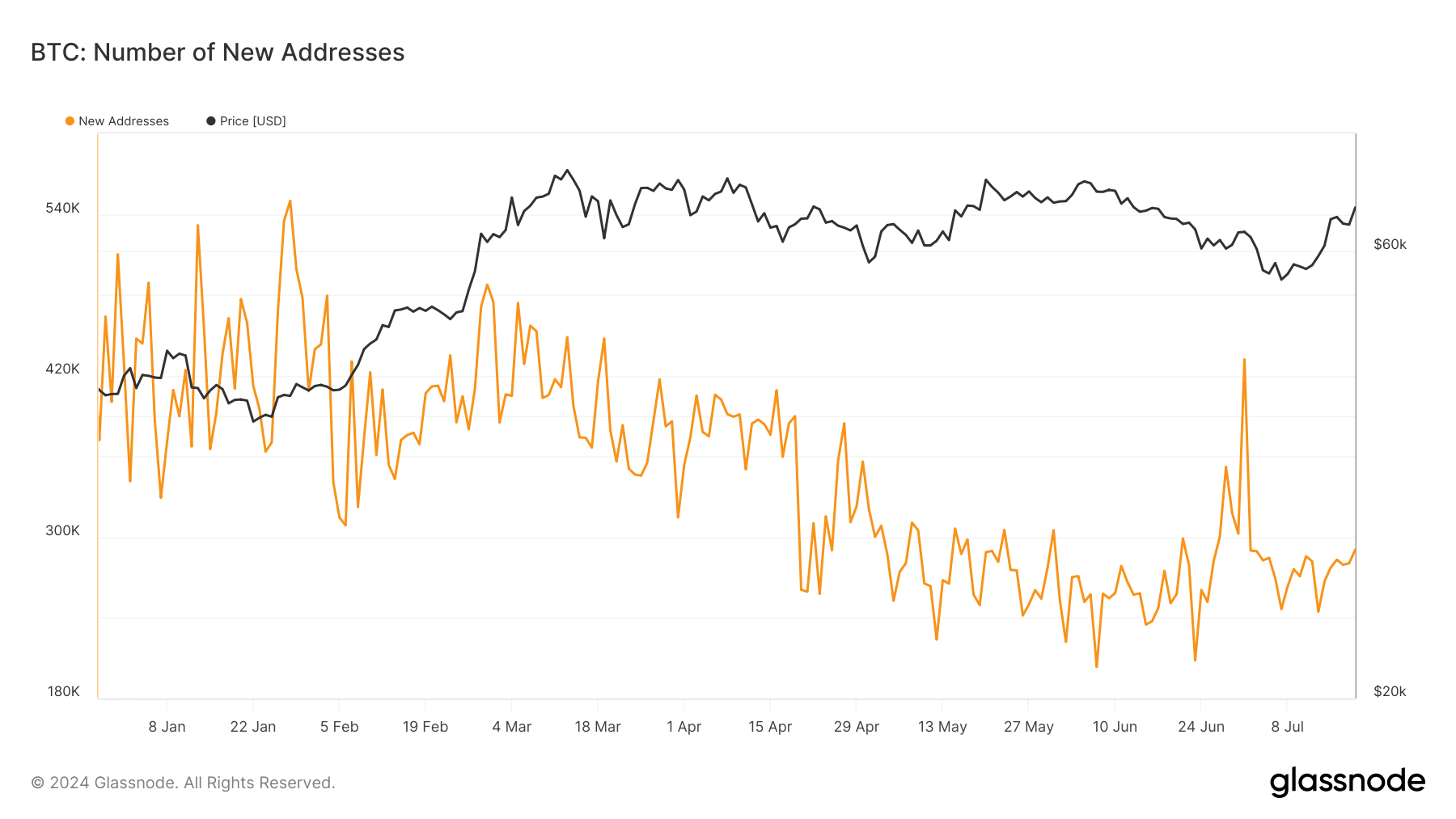

This price increase was also accompanied by an increase in new addresses.

Bitcoin whale wallets reach a new milestone

According to data from IntoTheBlock.com, Bitcoin whales have now reached a significant point in their accumulation. The number of wallets holding 1,000 BTC or more has increased to 7.9 million bitcoins.

At the current exchange rate, these holdings are worth almost $529 billion. This represents a large portion of Bitcoin’s market capitalization, which is over $1.3 trillion.

This level of accumulation is notable because it has not been seen in the past two years. It indicates a significant increase in wallet holdings.

This trend suggests that large investors are either holding their positions tighter or are actively accumulating more BTC. In either case, the investor is betting on the long-term value of BTC despite short-term volatility.

New Bitcoin addresses are increasing slightly

The above data analysis also revealed a positive trend within the Bitcoin network. This was characterized by both the increasing holdings of Bitcoin whale wallets and an increase in the daily number of new addresses.

Around July 13, after a sharp drop in the charts, new Bitcoin addresses started to increase, rising from 244,578 to almost 291,000.

Source: Glassnode

This uptrend in new address creation is an indication of renewed interest or a new influx of participants. This increase in new addresses could contribute to increased network activity and liquidity, which can lead to higher prices.

When viewed in conjunction with the significant accumulation of Bitcoin whales, these trends provide a clear picture of where the market stands at the moment.

New users can increase trading volume. While large holders continue to consolidate, they are a sign of confidence in the long-term value of BTC.

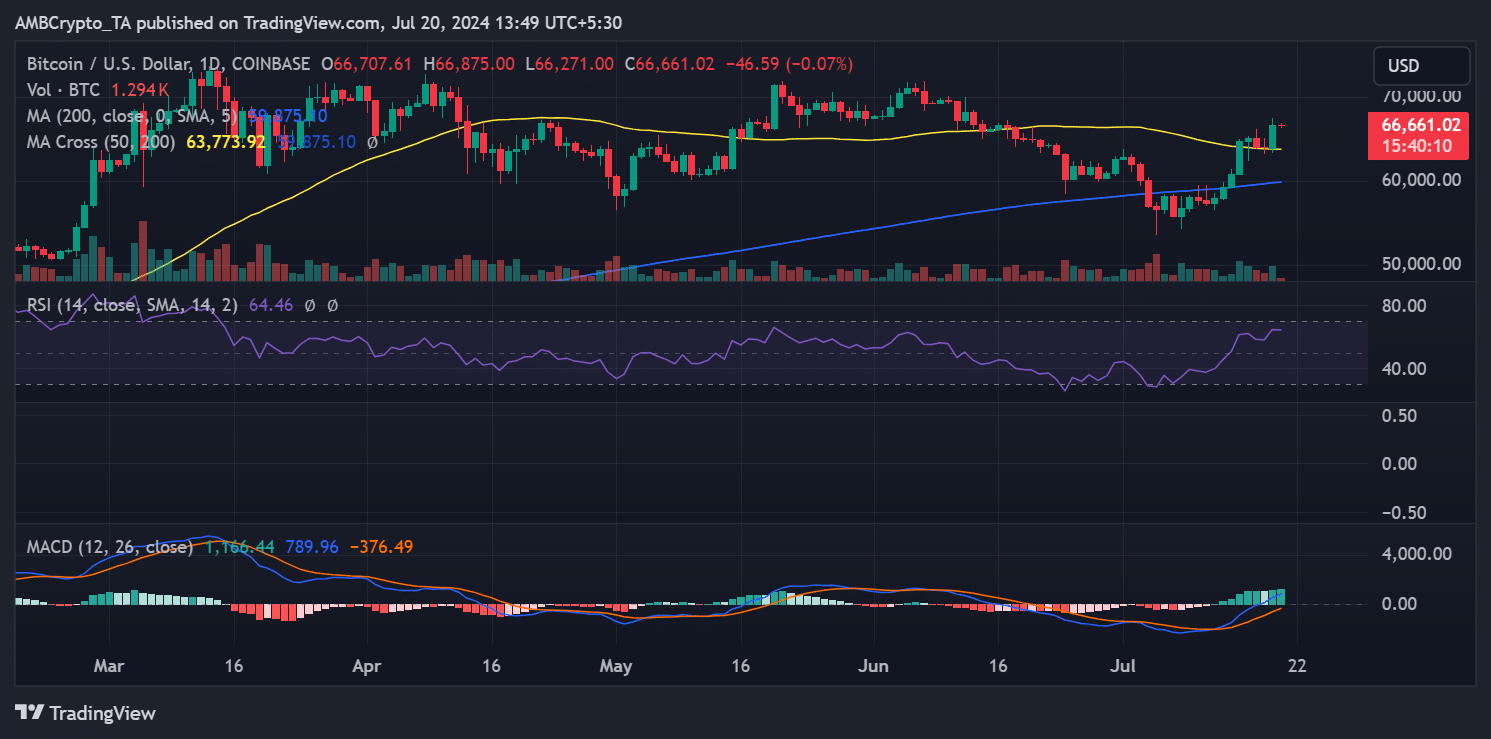

BTC enters a new price zone

A second analysis of the Bitcoin trend showed a notable uptrend of over 4% at the close of trading on July 19. This price increase pushed the cryptocurrency’s chart up from $64,000 to $66,000.

TradingView

– Read Bitcoin price predictions 2024–25

The value of Bitcoin in whale wallets (those who own 1,000 BTC or more) increased as a result. It now stands at approximately $529 billion.

It is important to note that despite a slight decline since its peak, Bitcoin price has managed to stay in the $66,000 range.