Why Do Pepe Investors Prefer HODL Rather Than Sell?

![]()

Journalist

- PEPE whales have bagged billions worth of tokens, indicating a short-term price surge.

- The NVT ratio suggested that PEPE’s price may drop before the pump.

Four different investors bought large amounts of Pepe [PEPE] In the last 24 hours, Lookonchain posted a blog.

One participant withdrew 350 billion PEPE tokens on Binance using Etherscan’s proof and post [BNB].

This withdrawal confirms the decision not to sell the token in the near future. During the same period, one buyer withdrew 101 billion tokens worth $885,000.

Other purchases include a massive accumulation of $123.66 billion and $74.5 billion.

AskFX reported similar activity multiple times.

The big players are preparing for battle

If this happens, it means that all parties involved are preparing for a significant price increase.

This type of accumulation has also proven to be a sign that PEPE’s value will increase.

PEPE was trading at $0.00000875 at the time of publication, representing a modest increase of 1.32% in the last 24 hours. The token could rise even higher.

AskFX first looked at the other on-chain metrics. This was done to see if the optimistic forecast was valid. We considered the exchange rate as our first metric.

Santiment data shows that 63.55 million PEPE tokens left exchanges in the last 24 hours. 63.55 million PEPE tokens left exchanges in the last day, while 2.48 million entered the platforms.

Source: Santiment

The difference between the inflows and outflows from exchanges suggests that more investors are planning to hold the memecoin rather than sell it.

This update suggests that PEPE may not see a major decline in the near future. The price of the token could be set to revisit $0.000010.

Taking it step by step

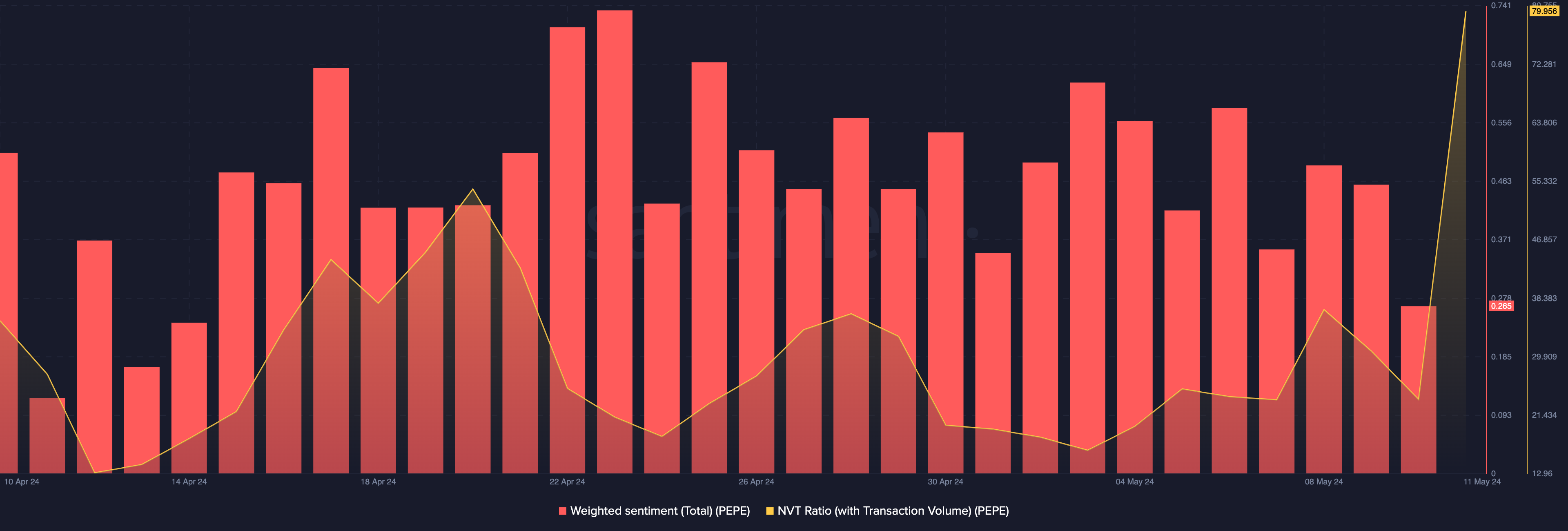

Market participants are not convinced about PEPE’s upswing. AskFX noticed this after looking at the weighted sentiment.

Weighted sentiment is a measure of the unique comments about a particular project, whether they are positive or negative. The weighted sentiment was at 0.26 at press time.

A positive value indicates that the majority of comments about memecoin are positive. However, this value has been declining since May 9, suggesting that optimism has waned.

PEPE can recover as long as the sentiment does not turn negative. The NVT ratio jumped to 79.95.

Source: Santiment

NVT stands for Network Value to Transaction and tells us whether a network’s market capitalization is justified by its transaction activity. When NVT is low, the market is growing faster than volume.

Is your portfolio in the black? Check out the PEPE profit calculator

In this case, the price could be preparing to rise.

The rise in the PEPE NVT ratio implied that the market capital was growing faster than volume. This would suggest that the price could initially trend lower before making a big jump.