Why RNDR’s 13.41% Surge in August Could Mean $30 per AI Token

Contributor

- RNDR is up 13.41% in the last seven days.

- The recent surge led analysts to predict a $30 value for RNDR by August.

After weeks of decline, Bitcoin [BTC] started a recovery with a gain of 1.68% in seven days and a 3.68% increase in 24 hours, trading at $63,000 at press time.

Bitcoin’s recovery is good news for altcoins as they too have started to recover with recent gains. As such, Render [RNDR] has enjoyed being part of the altcoin market recovery.

In the last seven days, RNDR is up 13.41%, with an 8.65% jump in the past day. RNDR’s trading volume increased 101.13% to $124.4 million over the same period.

According to CoinMarketCap, RNDR’s market cap has increased by 8.63% to $3.03 billion.

These recent gains have made the market sentiment optimistic and analysts are starting to predict a sustained uptrend.

Well-known crypto analyst and RNDR investor @RENDER_DADDY expected a bull run for RNDR after the recovery. On X (formerly Twitter), he shared that

“RNDR could be at $10 by the end of the week.”

He added:

“RNDR almost quintupled from $3 in January this year to March, which took less than 3 months. Next target by August is $30-40. Keep waiting for $5, good luck.”

According to this analyst, based on RNDR’s historical performance, we can determine its future; so after the consolidation phase, the run will repeat.

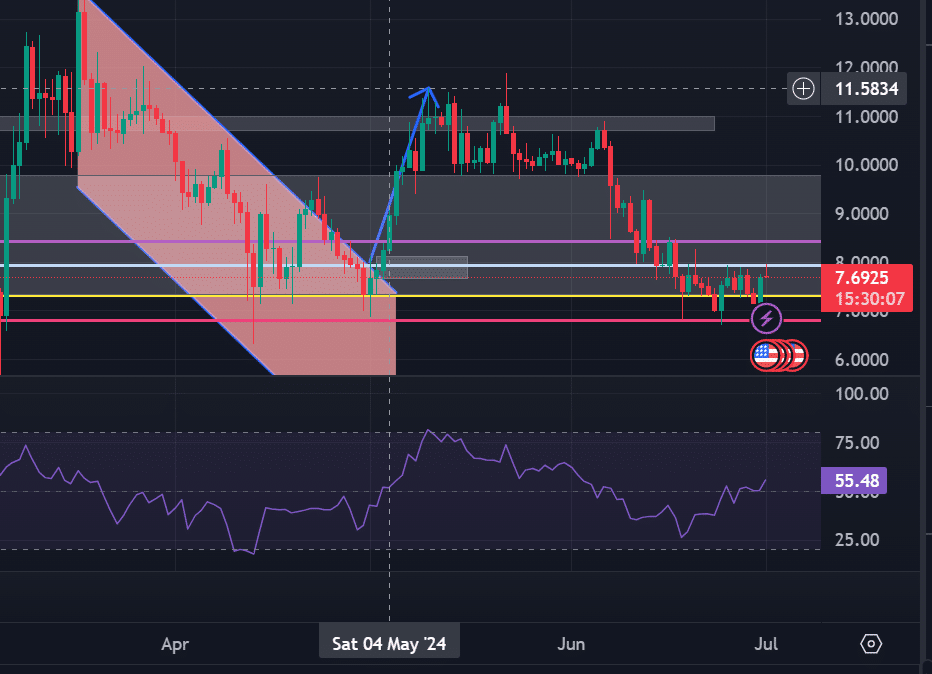

What RNDR’s price charts show

According to AskFX’s analysis, RNDR’s Money Flow Index has risen from a low of 37 to 55 at press time over the past seven days. The continuous increase indicated increasing buying pressure and a continuation of the uptrend.

Source: TradingView

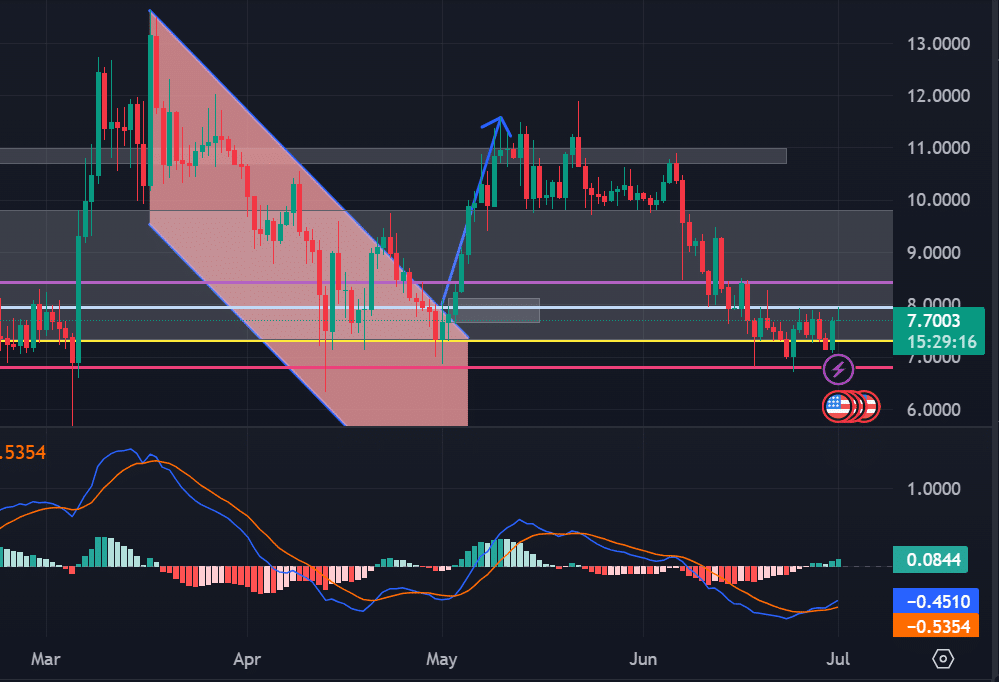

Furthermore, the Moving Average Convergence Divergence (MACD) suggested an uptrend. At press time, the MACD line was above the signal line, which was bullish and showed that prices would rise.

Additionally, the histogram was above zero at 0.925, which was a bullish sign.

Source: TradingView

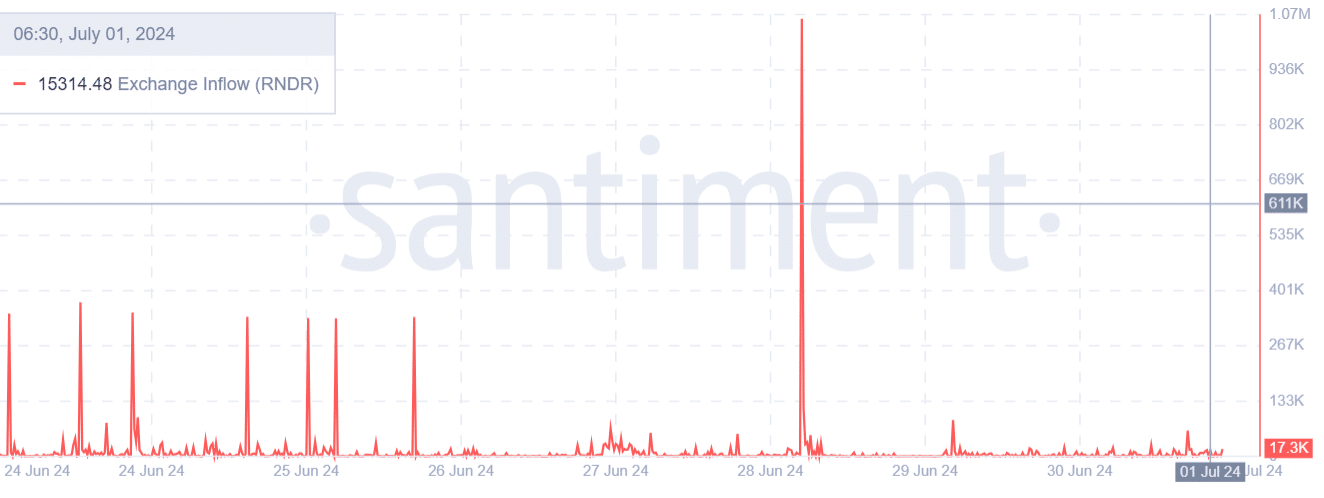

Looking closer, AskFX’s analysis of Santiment suggested a decline in exchange inflows over the past seven days. Exchange inflows have declined from a high of $1.05 million to a low of $17.3K.

Falling exchange inflows mean that few investors are selling their cryptocurrencies. This reduces the selling pressure, which has a positive impact on altcoin prices.

Source: Santiment

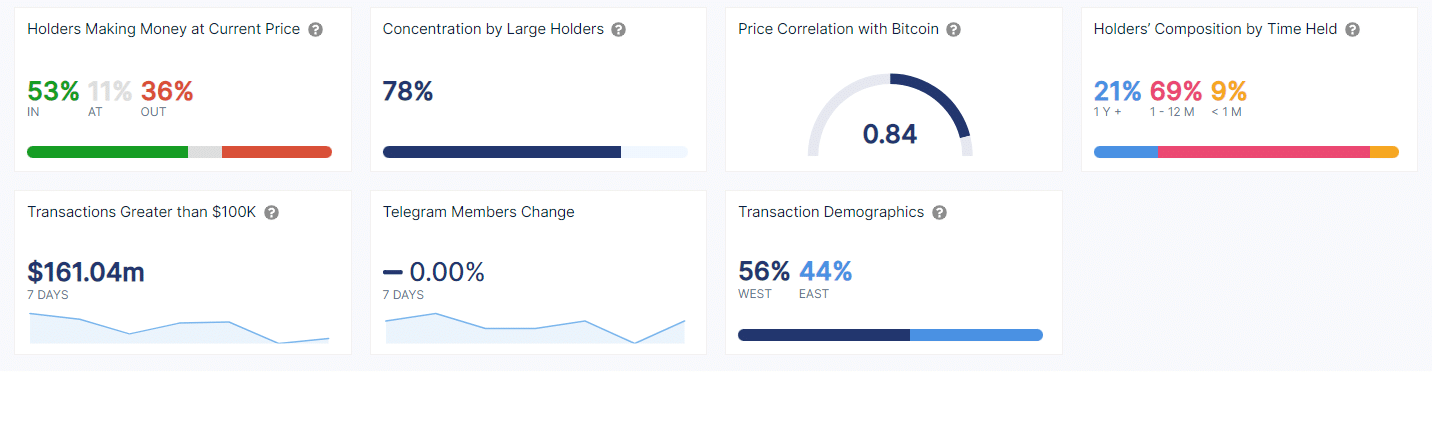

according to IntoTheBlock, 53% of holders were profitable at press time, which increased investor optimism. A 78% accumulation by large holders showed that investors had confidence in the altcoin trend.

Source: IntoTheBlock

Read Renders [RNDR] Price Prediction 2024-2025

How bullish can RNDR get?

At press time, RNDR was trading at $7.84. If the current positive trends continue, the altcoin will break the resistance level of around $7.94.

A breakout from this zone will try to challenge the next resistance level at $8.42 in the short term. With a very strong demand zone around $6.83, it will fall to a critical support level at $7.3 in case of a price correction.