WIF Is Fighting for Survival in a Stagnating Market: A Pessimistic Mood Is Emerging

Journalist

- WIF is struggling to find necessary buyers within the six-week time frame.

- Weak demand has resulted in potential further losses.

Dogwifhat [WIF] Pepe [PEPE] Bonk [BONK] has experienced heightened volatility in recent days. However, WIF continues to face a downward trend in the short term.

WIF has not shown strong upward momentum and buying pressure remains low. Dogwifhat investors should exercise patience. Will the situation improve soon? Should they consider buying on the next dip or wait longer?

Once again, the middle level has proven to be a significant obstacle

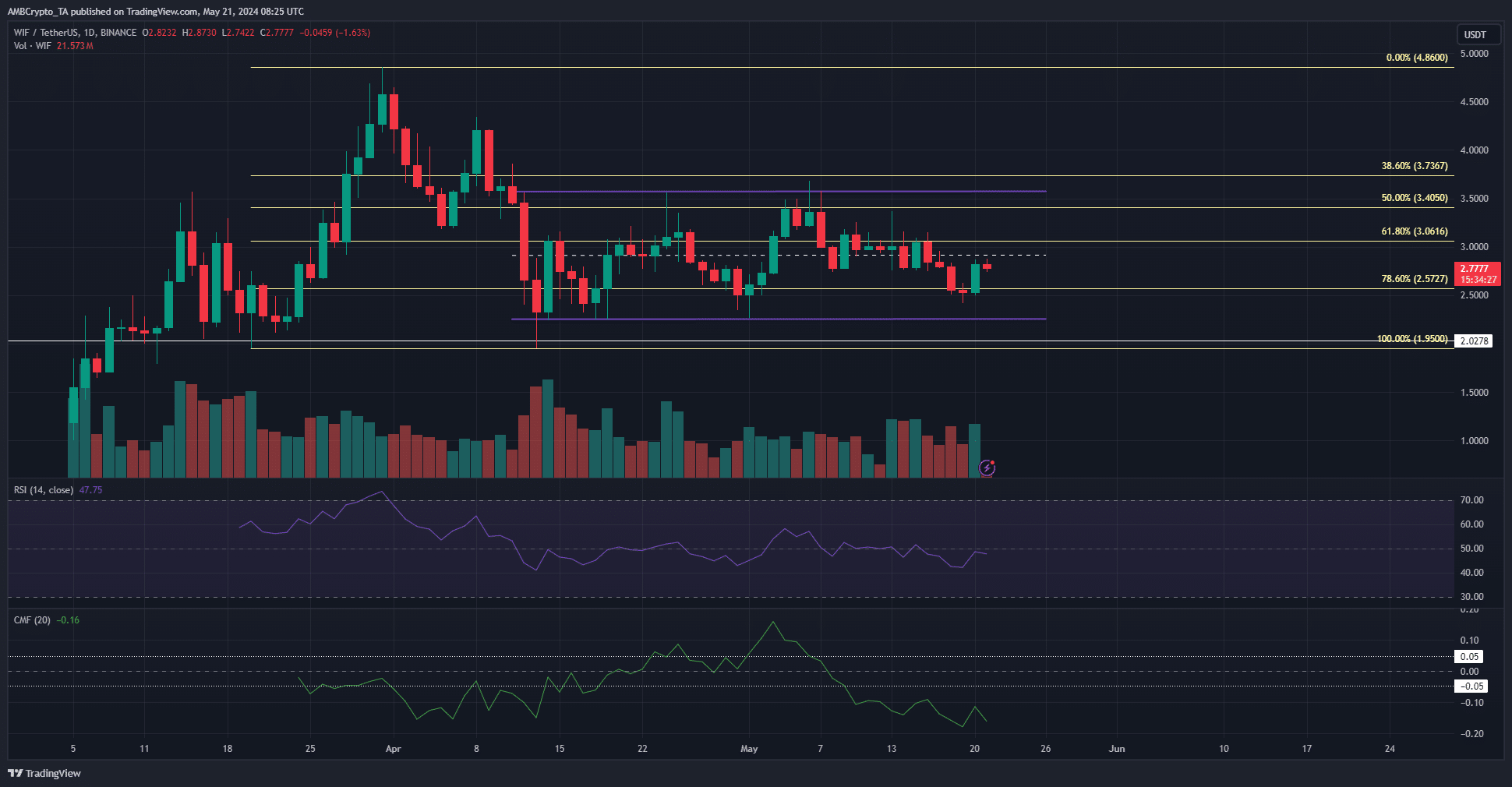

Source: TradingView, WIF/USDT

WIF has traded within the six-week range highlighted in purple, extending from $2.25 to $3.58.

The middle price level of $2.91 has served as both resistance and support within this range.

Fibonacci levels (pale yellow) have highlighted the critical support level of $2.57, but this level has been breached over the past six months, contributing to an ongoing bearish bias.

The failure of bulls to defend the middle support earlier this month indicated the advantage shifting to the bears.

At the time of publication, the RSI had also fallen below the neutral 50 mark, signaling a shift in momentum to the downside. The CMF at -0.16 indicates significant selling pressure.

Bulls need to push prices above the range highs in order to counter the bearish outlook.

Bulls Fight Back: Indications

Prices trended lower from May 13 to May 19. On some days, such as May 17, the funding rate was +0.01% while open interest rose and prices fell.

The positive funding rate, while not negative enough to indicate a large number of short sellers, suggested a pessimistic sentiment and a bearish trend.

Read dogwifhats [WIF] Price Prediction for 2024-25

Significant changes have occurred in the past two days. The funding rate has increased and spot CVD has risen to reflect heightened demand.

Open interest has not risen significantly, indicating that speculative activity is still on hold. However, the other two indicators show early signs that a reversal in the uptrend is imminent.

Disclaimer: This information is not intended to be a source of financial, investment, trading, or any other type of advice. It represents the sole opinion of the author.