XRP Aims to Break Out of 6-Year Pattern: Is a New ATH Imminent?

Journalist

- The price of XRP has increased by more than 12% in the last seven days.

- Most metrics and market indicators looked bearish for the token.

XRP showed a promising rally last week as its price saw double-digit growth last week. The better news was that it could get even more bullish in the coming weeks as the token was close to breaking a long-term bullish pattern.

XRP Multi-Year Bullish Pattern

Data from CoinMarketCap showed that XRP bulls controlled the market last week as its price rose by more than 12% in the last seven days.

At the time of writing, the token was trading at $0.5948, with a market cap of over $33 billion, making it the seventh-largest cryptocurrency. Meanwhile, the token was preparing to break out of a multi-year bullish pattern.

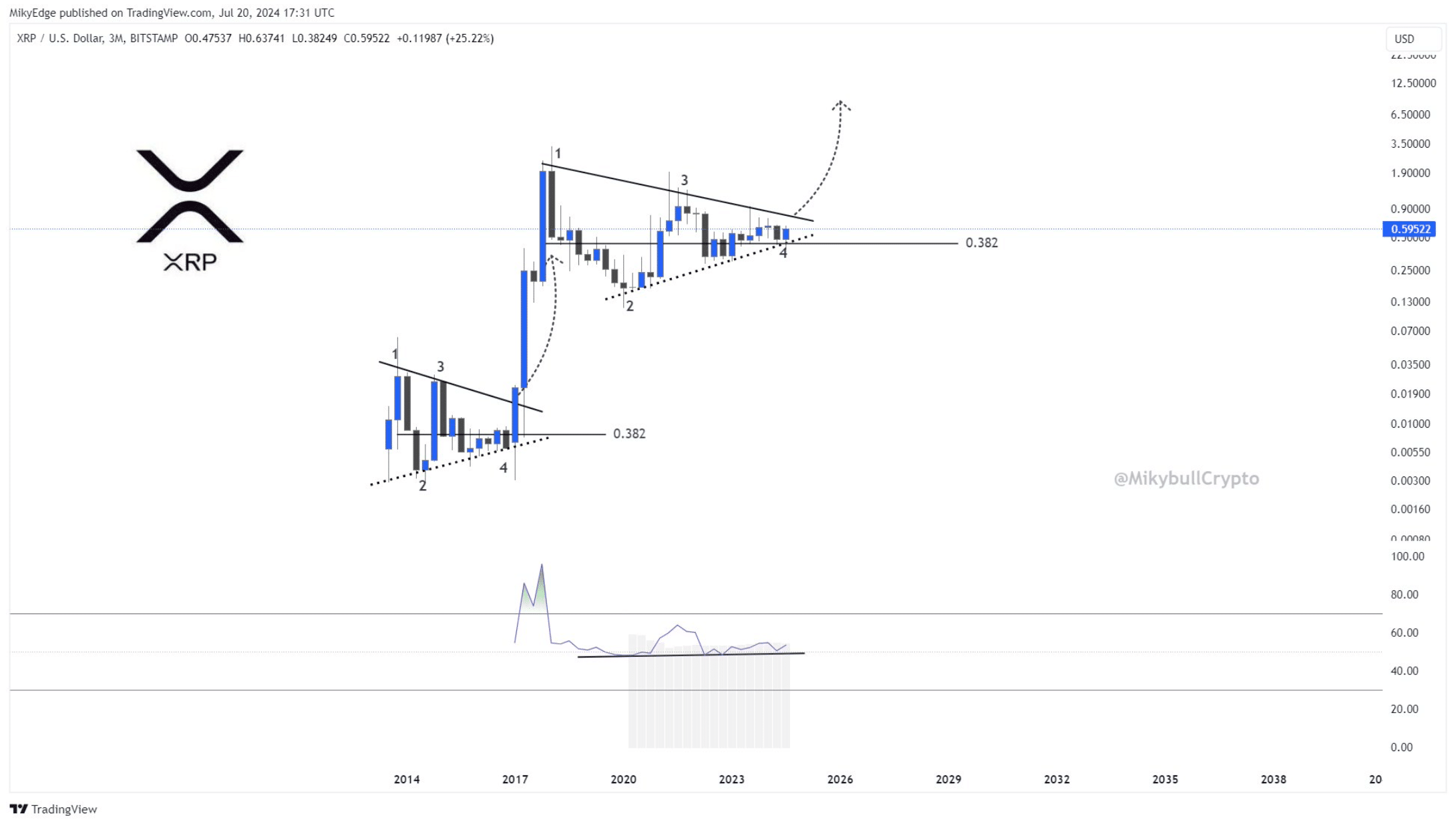

Milkybull, a well-known crypto analyst, posted a tweet revealing a bullish pennant pattern on its price chart that has been ongoing for 6 years. According to the tweet, the pattern appeared on the XRP chart in 2018–2019 and has been consolidating within it ever since.

At press time, it was close to breaking out. In case of a breakout, the token could start another bull rally. In fact, the possible bull rally could push XRP to an all-time high in the coming weeks or months.

Source: X

Will XRP finally break out?

AskFX then planned to take a look at the token’s on-chain data to see if it suggested a possible breakout in the near future.

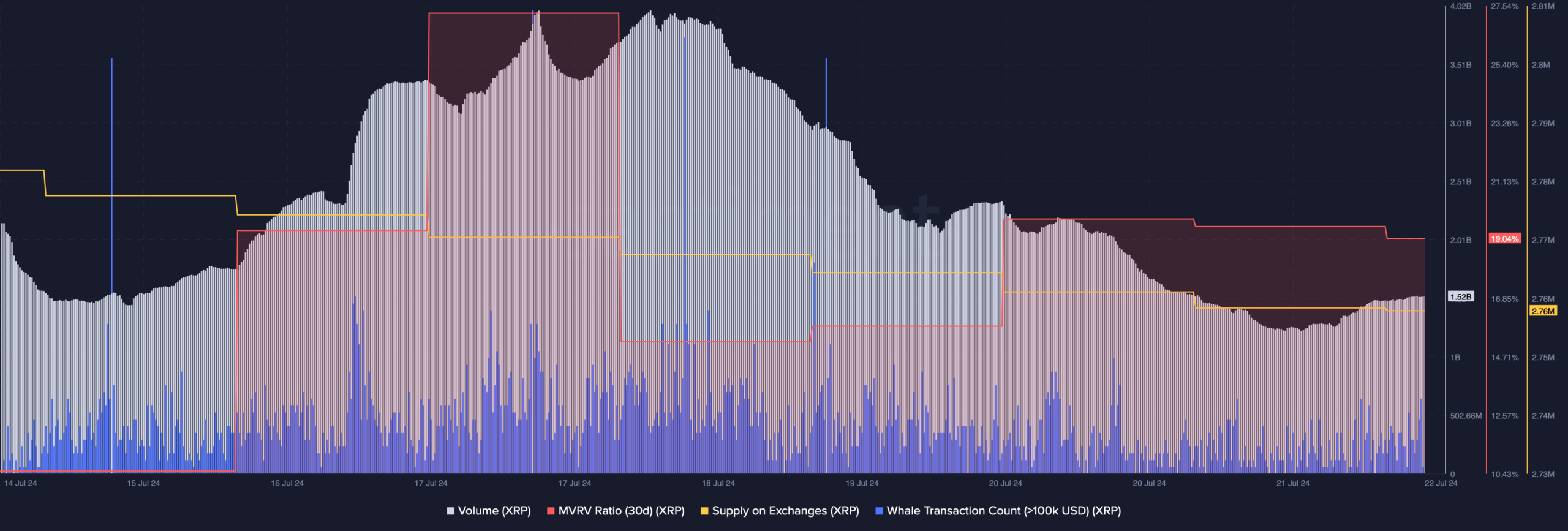

Our analysis of Santiment’s data revealed that the supply of XRP on exchanges has been decreasing. This clearly meant that investors were increasing their accumulation.

However, the rest of the metrics looked quite bearish. For example, the token’s MVRV ratio has dropped over the past week. Its trading volume has also dropped, suggesting that the ongoing bullish price trend may not last.

In addition, XRP’s whale transaction count has also decreased, suggesting that whales have not been actively trading the token. Another bearish indicator was the Fear and Greed Index which recorded a reading of 69% at press time.

This meant that the market was in a “greed” phase, which often leads to price corrections.

Source: Santiment

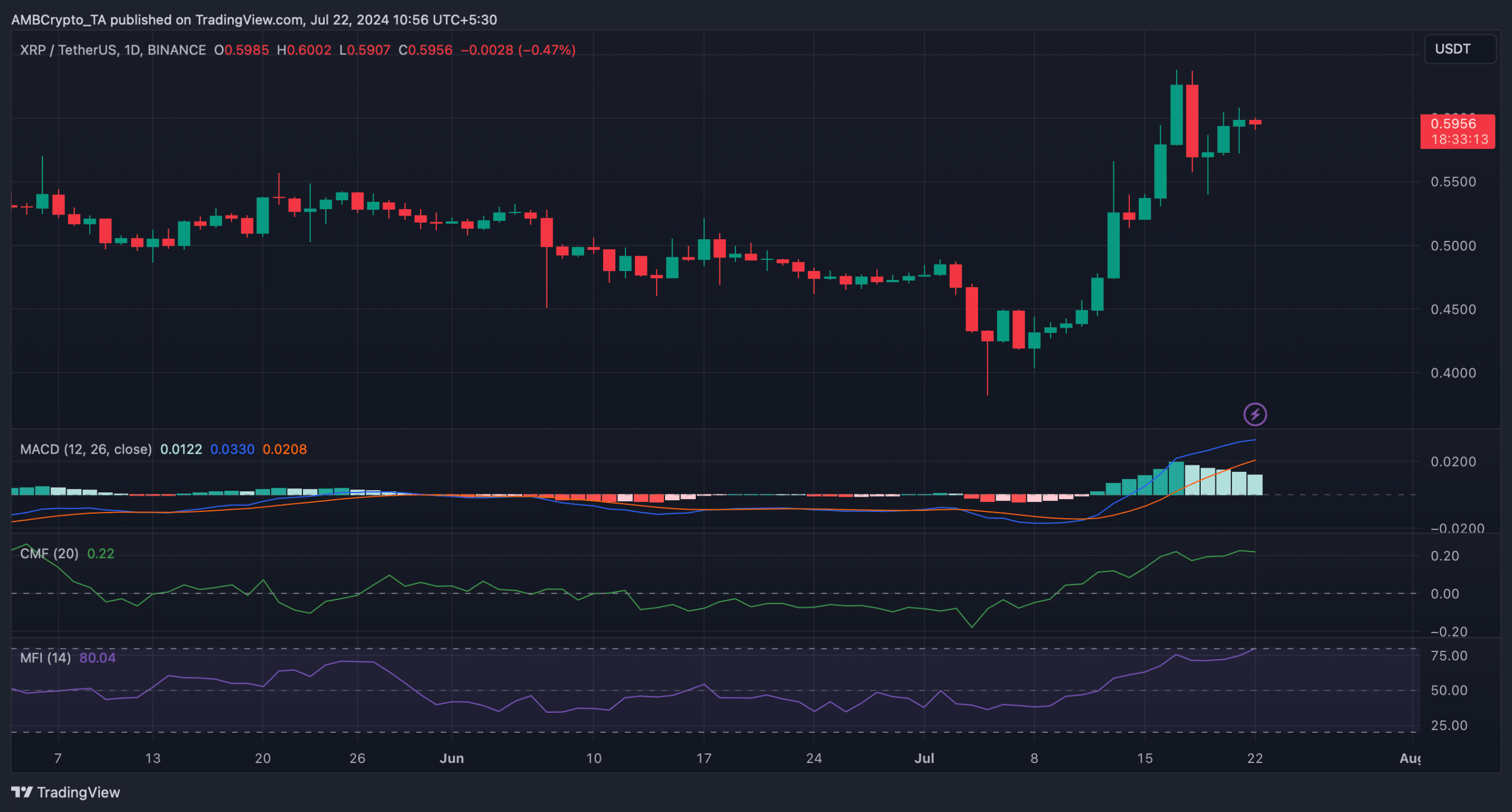

We then looked at the daily chart of the token. We found that the Money Flow Index (MFI) was about to enter the overbought zone, which could lead to increased selling pressure in the coming days.

Read Ripple’s [XRP] Price Prediction 2024-25

Moreover, its Chaikin Money Flow (CFM) also recorded a slight downtrend. These indicators suggested that it might take longer for XRP to break out.

Nevertheless, the MACD remained in favor of the bulls.

Source: TradingView