Xrp, Doge and Link Are the Biggest Altcoins to Win as Bitcoin Is at 35,000

-

BTC’s price was little changed, while large-cap altcoins gained between 5% and 10% in a growing crypto rally.

-

Analysts said a decline in Bitcoin market capital dominance is a sign that investors are taking a riskier approach to the market.

-

The ByteTree analyst hinted at the first signs of a potential altcoin season. They added altcoins to their portfolio at the expense of BTC.

Altcoins, alternative cryptocurrencies, posted gains of between 5% and 10% on Monday as Bitcoin (BTC), a riskier cryptocurrency, was pushed to the $35,000 mark by investors.

After Ripple received approvals to offer and operate in Georgia and Dubai, XRP rose almost 10% on the day. It surpassed Binance’s BNB to become the fourth largest cryptocurrency by market capitalization.

Blur’s Token (BLUR), a non-fungible token marketplace, increased its gains by 32% today. The price of the token has more than doubled in a single month. At this point, the platform is preparing for an airdrop on November 20th that will distribute 300 million tokens to users.

Bitcoin traded in a tight range on Monday, just above and below $35,000. Not much has changed with Ether (ETH) either.

The Market Index, a basket of cryptocurrencies that includes a wide range of currencies, rose 0.6%.

The decline in Bitcoin dominance has led to an altcoin boom

The altcoin’s outperformance, although it has only existed for a few days, could be an indication that traders are continuing to capture profits from BTC’s October rally of around 30% moving towards digital assets with lower capital.

TradingView data shows that Bitcoin’s dominance in the market capitalization metric – which measures a crypto asset’s share of total market capitalization based on its market value – has fallen to 52.5% from 54.3% at the end of October. According to TradingView, this was a 30-month high at the time.

Matteo Greco said in an email: “The decline in dominance after five consecutive weekly increases marks the first sign of increased investor interest in altcoins. This suggests a riskier market stance.”

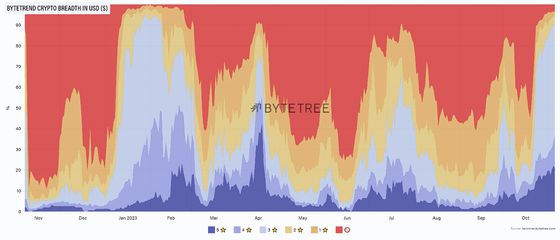

ByteTree, an investment advisory firm, suggested that altcoin markets would outperform BTC for an extended period as the crypto rally increased market breadth. The likely end of the Federal Reserve’s interest rate hike cycle also provided a more favorable climate for risky assets.

The crypto market has become broader (ByteTree).

By reducing BTC weight, the company has NEAR token (NEAR), Stacks (STX), a Bitcoin-based platform for smart contracts and LINK and XRP added.

Blockchaincenter’s data suggests that while BTC’s rally has extended to altcoins, it is still not big enough for an altcoin season.

The 50 largest digital assets outperformed BTC in the last 30 days, and 33% of them did so in the last 90 days. This is below the 75% threshold to qualify for the altcoin season.