XRP Whales Continue to Collect Tokens Despite Price Drop: Is a Recovery Imminent?

Journalist

- Data showed that XRP whales did not join the broader sell-off.

- The price of the token could also rise if long-term holders refrain from selling.

Ripple has remained a positive player in the market despite its current state. [XRP] Whales have chosen not to add fuel to the fire. They are choosing to buy more tokens.

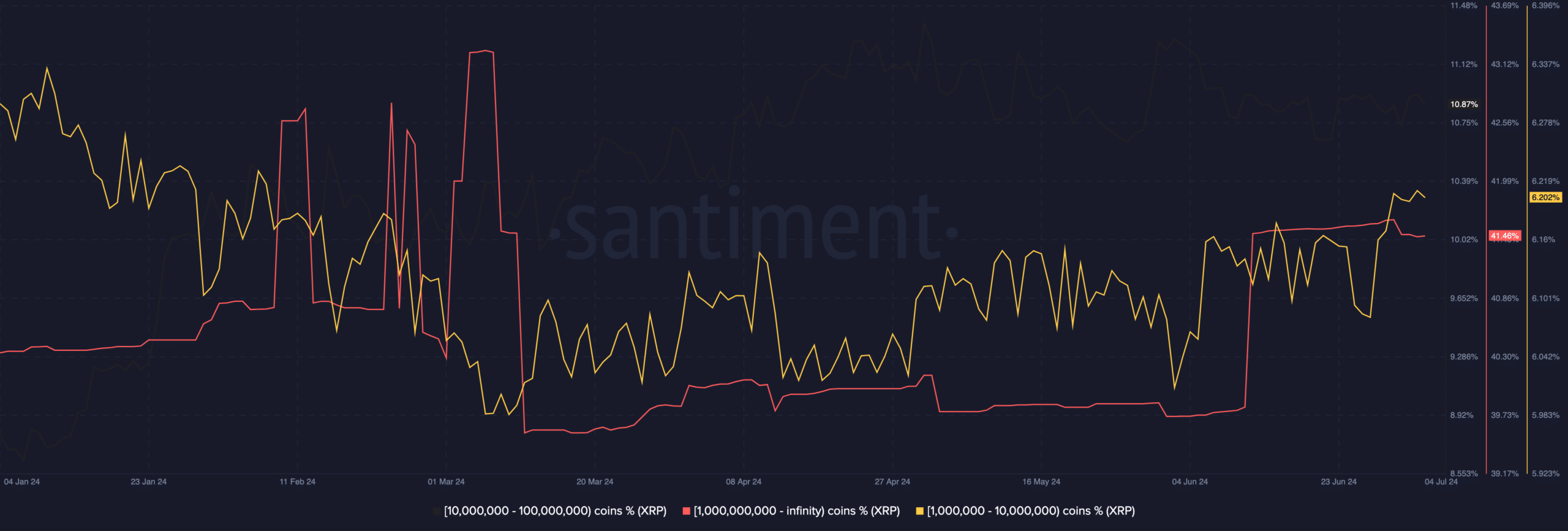

Santiment reports that the balance of addresses of XRP token holders holding more than 1 billion tokens was 39.81% in mid-June. At the time of publication, this ratio had increased to 41.46%.

The big players offer a solution

The balance increased from 6.08% to 6.20% for the 1-10 million group. Whales are entities that own large amounts of cryptocurrency. Their actions therefore have a major impact on prices.

Prices stabilize when things like a recent accumulation happen. Sometimes prices can recover.

Source: Santiment

As of this writing, XRP is currently at $0.43, down 6.52% in the last 24 hours. Due to recent whale activity, the price could stabilize at current levels or even rise to $0.45.

It is important to remember that whale accumulation alone will not stop the price from falling. AskFX decided to evaluate other events on the chain itself.

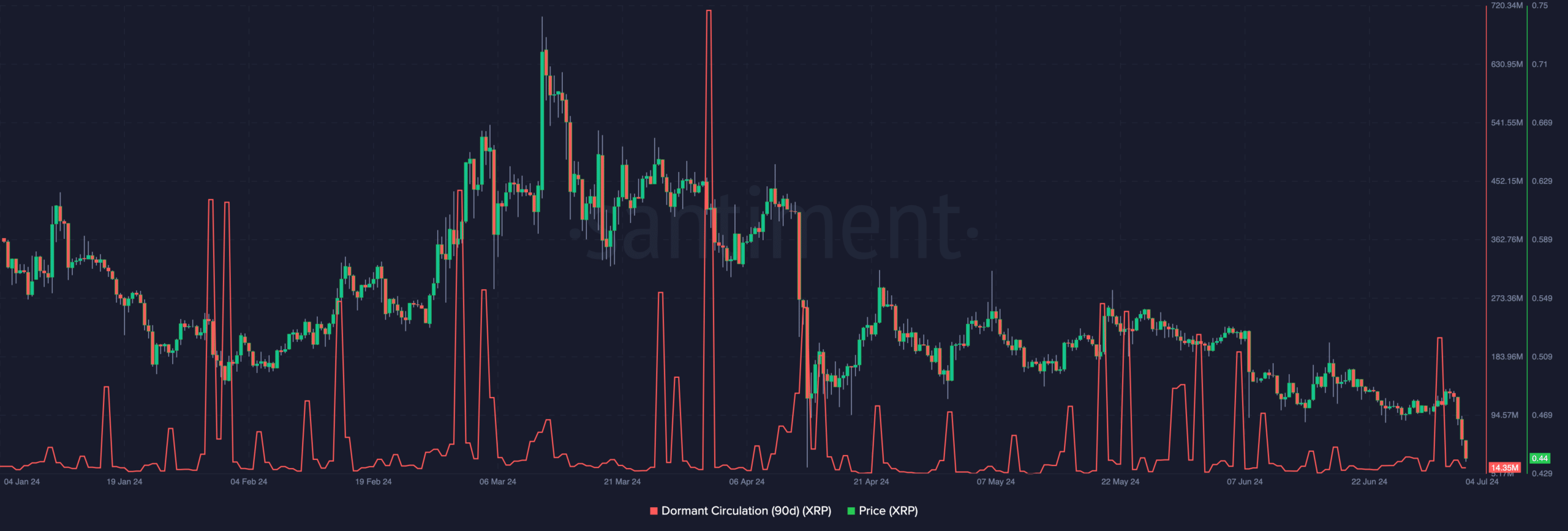

We looked at dormant circulation. This metric measures how quickly tokens that have been stored for a while are used for transactions.

When dormant circulation increases, it means that tokens have moved from self-custody to active trading. This means that token holders are ready to sell.

XRP price is striving to rise above resistance

This resulted in a price drop. The opposite happens when dormant volume is low. This was the case during the time of the press release. On July 1, XRP’s 90-day dormant supply skyrocketed.

However, at the time of publication, there were only 14.35 million. The drop in tokens is a sign that long-term holders have not moved their tokens out of cold wallets.

If XRP continues, it could prevent a further decline as originally mentioned.

Source: Santiment

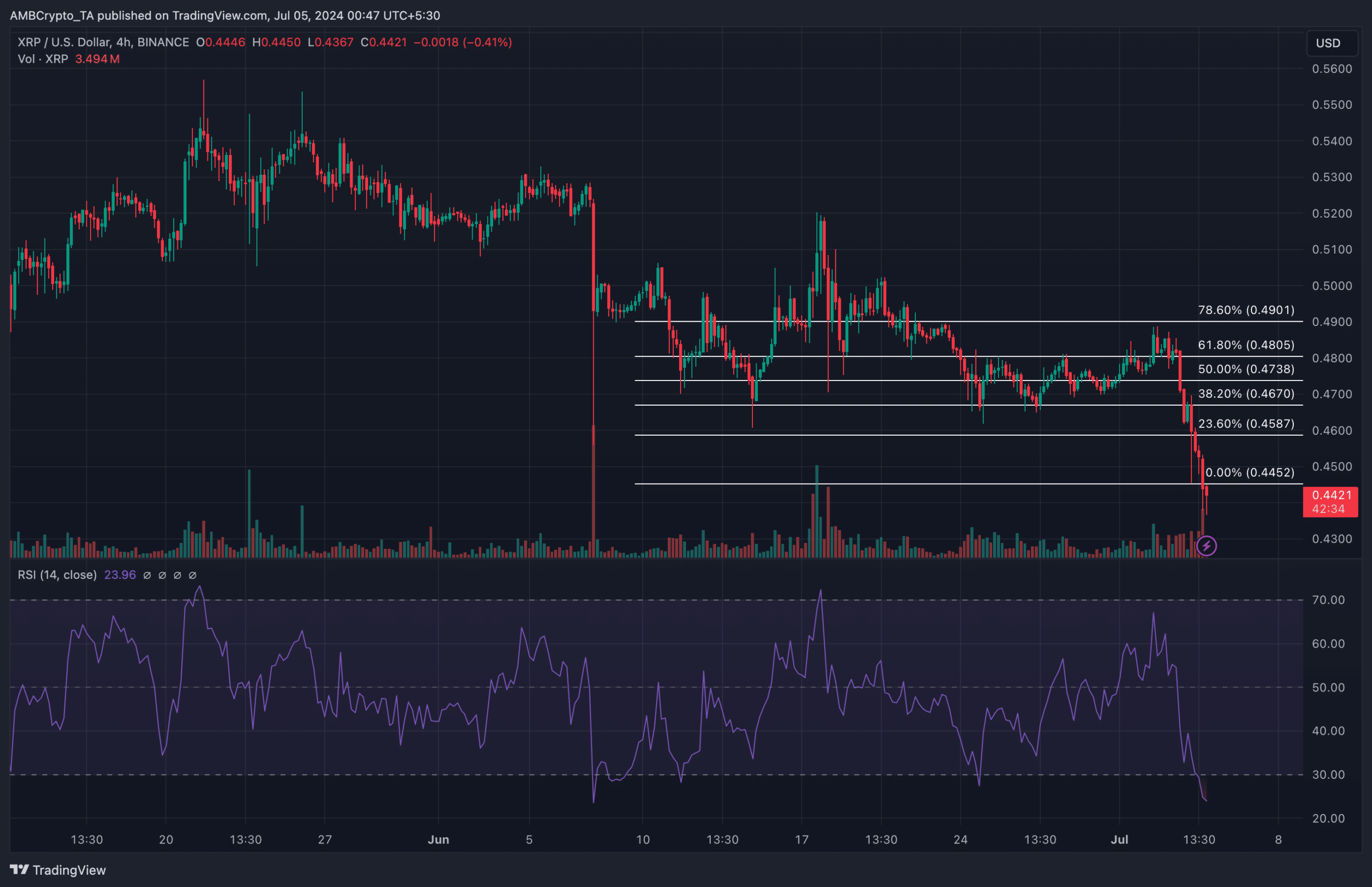

We also analyzed XRP from a technical perspective. On the daily chart, the Relative Strength Index was 23.96. The RSI is a measure of momentum based on the magnitudes of price changes.

When the value is higher than 70, an asset is overbought. However, if the value is below 70, it indicates oversold.

The price of XRP could therefore recover. AskFX has used the Fibonacci retracement indicator to check possible targets. This indicator identifies potential support and resistance levels.

TradingView

Read Ripple’s [XRP] Price Predictions 2024-2025

If XRP bounces off the lows on the chart, it could reach the 23.6% Fib level at $0.45.

However, this prediction could be invalidated if selling pressure increases and whales join in.